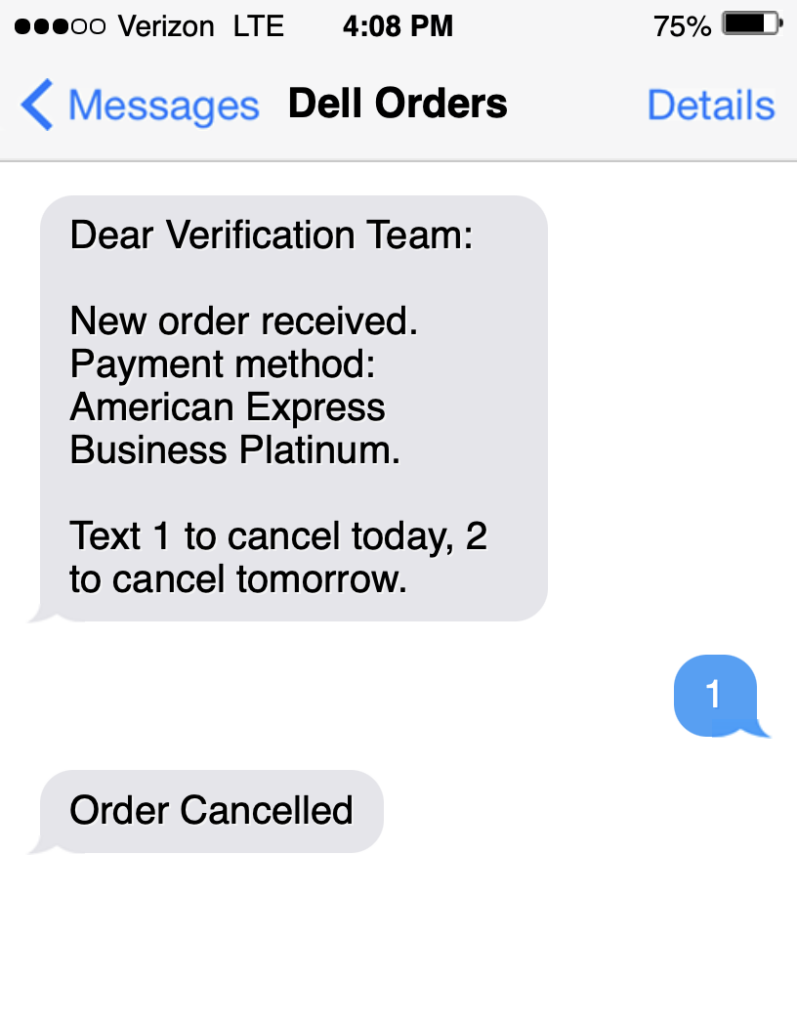

- Staples has a fee free $200 Mastercard sale starting Sunday and running through the following Saturday, and we’ve ping-ponged (or maybe zig-zagged? yo-yoed? teeter-tottered? ebbed-and-flowed? Sorry, I’m getting off track) back to a limit of five per transaction.

These areMetabankPathward gift cards, so have a liquidation plan in place. - One of my wishlist cards after dropping below 5/24 is the Hyatt Business card even with its hefty $199 annual fee, and there’s good news for me and anyone (un)fortunate enough to be like me:

– This is my last month before dropping below 5/24

– The sign-up bonus has increased to 75,000 Hyatt points after $12,000 spend

If you spend for status or if you have plenty of award stays at Hyatt, this card is a keeper. Otherwise, it’s probably a skip because you can get an Ink Preferred 100,000 Ultimate Rewards sign-up bonus with $8,000 in spend and a $95 annual fee, then transfer those points directly to Hyatt. - Do this now: Register for 20,000 bonus Bonvoy points after a three night stay at Marriott Homes and Villas booked between now and September 24 for stays through January 26, 2024. (Thanks to FM)

- Southwest has a fare sale for fares booked by September 17 for travel at least 30 days out, with requisite blackouts around winter holidays. If you have existing travel booked, it’s a good time to re-fare.

Pictured: Staples team setting purchase limits on gift cards with safety fans, week 47.