Introduction

In what has become an annual MEAB tradition for three years in a row (and trust me, if I do something three years in a row it’s a Ron Burgundy style “kind of a big deal”), it’s time for another installment of Travel Hacking as Told by GIFs, but without Ron Burgundy.

Previous versions:

As a certain prolific human wrecking ball and worlds fastest beta tester likes to tell me, LFG!

The GIFs

Getting ready for the MEAB 2022 Travel Hacking as told by GIFs post.

We started the year with most American Express business cards offering bonuses of up to $200 per card or 20,000 Membership Rewards per card, up to 99 times. Yes, it was a huge bonus, but we had to prepare for a bunch of small talk and impatiently waiting while a phone rep adds 99 variations of your name to your account.

Pictured: 99 AU cards with your name on them (go ahead and count, I’ll wait).

Mastercardgiftcard.com turned out to be a great way to hit minimum spend American Express cards for a chunk of the year, at least until they started charging cash advances, illustrated here.

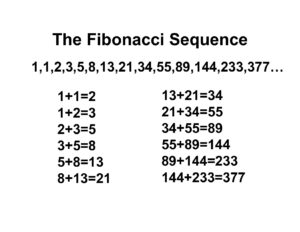

The silent response when MEAB geeked out with the Monty Hall problem applied to flights.

Chase drops the bonus for pay yourself back categories from 50% to 25% on the Chase Sapphire Reserve (probably) due to massive abuse and gaming.

After Southwest’s epic meltdown, we get to see their operations staff working on their computer crew optimizer in real time.

Plastiq announces that they’re going public via the Colonnade SPAC, and then produces a commercial outlining their 2023 business plans.

When a manufactured spender successfully executes an AmEx triple dip.

American Express tries to convince us that this year’s Q4 referral bonus with +4x on travel and transit spend isn’t lame. We still remember the better 2021 4-for-us and best 2020 3-for-all variants of the offer.

Delta and Starbucks partner up, and mainstream bloggers see yet another 10 page puff piece in their future.

Capital One sees American Express with all the giant 250,000 point sign-up bonuses and decides it’s time to play ball. Then, American Express responds.

Nearside’s 2.2% cashback everywhere debit card announces by email that it’s shutting down.

A few hours later, Nearside emails everyone and says “J/K, J/K, we’re fine”

Then the next day, Nearside announces that no, it’s actually dying.

Kroger’s inner crazy-monologue sends itself a message about wiping out fuel points accounts, and then does it.

We watch as the Unsung Hero Synchrony Rakuten card slowly dies.

Brex decides that it’s going to focus on only large businesses and leaves everyone else high and dry.

Marriotts in Japan welcome their most loyal guests when tourism reopened in October.

Delta announces that they’re getting rid of the CRJ-200s from their fleet, and provides video of the final torture-tube flight.

Travel hackers look for Lubbock on the world map for some reason.

Kroger starts replacing US Bank gift cards with Metabank gift cards.

Southwest’s reservation system stops taking calls due to random equipment failures.

Trying to place orders at Dell looks great, until your order is cancelled after it’s confirmed.

We react to PayPal key going away.

J and F flyers realize what’s going to happen to award space now that Emirates awards can be booked with Air Canada Aeroplan miles.

MEAB prepares for the 2022 Travel Hacking as told by GIFs early in the year to make it easy later, and then face-plants via procrastination as the year moves on.

Thanks for reading friends! Just like Tanya in the White Lotus Season 2, I’m sure only good things are to come at MEAB!