- Do this now: Register for a targeted promotion from AA for flying in premium cabins, found on your promotions page. I got 10,000 bonus miles with two paid flights booked by November 11 in first, business, or premium economy and flown by December 19.

Without trying very hard, I found round trip fares in premium economy from my airport for about $160, or in first for about $250. I think you could do better if you live in ORD or MCO especially, but probably in lots of other places too. I really could also just try harder and do better. - Virgin Atlantic’s dynamic award chart changes are live for Virgin Atlantic metal awards. The gist:

– Cancellation fees are increased to $100 per ticket

– Transatlantic business class redemption cost range: 28,500 – 77,500 miles

– Transatlantic economy redemption cost range: 6,000 – 25,000 miles

– Award surcharges are also variable, often lower than before

– There is last seat availability for award redemptions

For now this is a positive net change and availability at low levels isn’t too hard to find, but I expect neither will be the case in three years. - United’s elite status requirements are increasing for elite year 2025, in both the number of Premier Qualifying Flights (PQF) and Premier Qualifying Points (PQP) required to reach different Premier Stupid Levels (PSL). On the plus side though, you can earn more PQPs from credit card spend (CCS) on premium co-brand cards, but the United Club cards are the only ones worth using with 1 PQP per $15 spend (P15S), up to 15,000 PQPs annually each for both the personal and business:

– Silver: 6,000 PQP, or 5,000 PQP + 15 PQF, or $90,000 card spend

– Gold: 12,000 PQP, or 10,000 PQP + 30 PQF, or $180,000 card spend

– Platinum: 18,000 PQP, or 15,000 PQP + 45 PQF, or $270,000 card spend

– 1K: 28,000 PQP or 22,000 PQP + 60 PQF, or $420,000 card spend

I don’t want to yuck your yum (YYY), but getting both a personal and business United Club card to earn 1.5x on $420,000 spend with no additional kickers doesn’t feel terribly appealing in light of a litany of other better options (OBOs). - Chase Offers has an offer for 5% back up to $45 on $100 or more in spend at British Airways.

- Southwest extended its schedule through August 4, 2025, so now’s the best time to lock in potential schedule changes for Summer travel.

These flights will still be of the open seating persuasion because apparently seat assignments aren’t coming until early 2026.

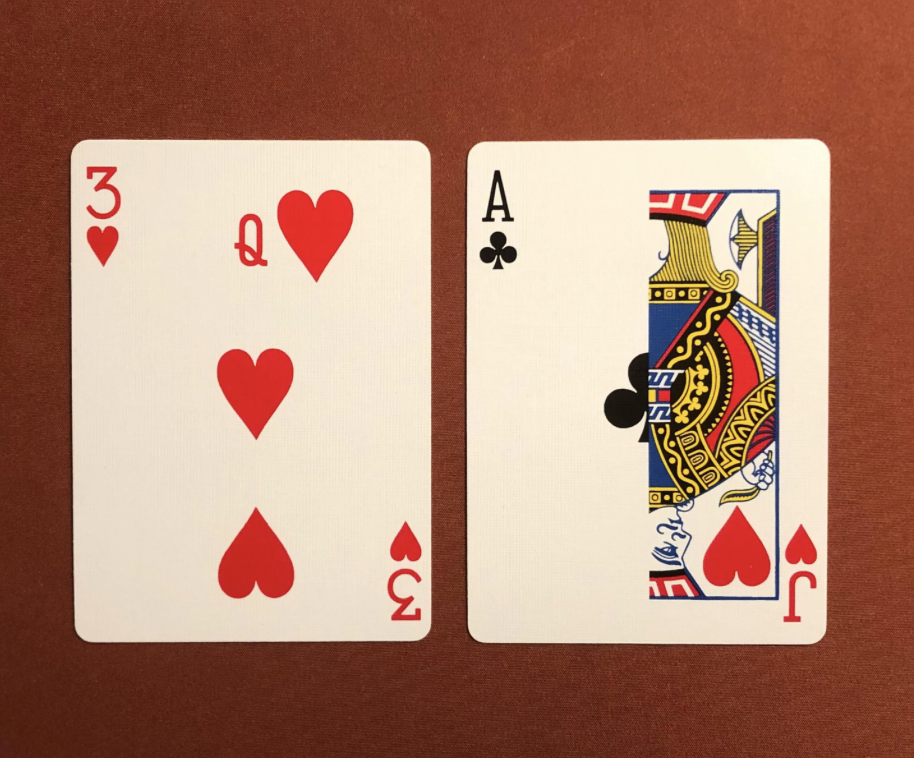

MEAB: Airline themed halloween costume idea central.