The Main Question

A common manufactured spend and churning question is, “how am I going to spend $15,000 in the next three months to meet my sign-up bonus?” This question is especially prevalent when you’re getting started, and focuses primarily on what methods you can use to meet your target.

At some point, your capacity for manufactured spend may grow substantially with experience. When that happens the question often becomes, “what cards do I have that support $100,000 in spend today, and how can I pay them off tomorrow without fraud locks, ACH kiting, or SAR reports?” When you’re asking this question, you’re no longer focusing on methods to meet spend, but instead on how you can increase throughput and move money and credit lines to meet the demand.

When You’re Operating with Big Numbers

The relevant follow-up questions for someone operating in the latter regime become:

- How do I cycle money through my accounts without kiting?

- Which card issuers are going to be upset by this kind of spend?

- What’s the best return I can get on a workhorse card?

The last question is interesting because it shows a big shift in how churning works. Realistically you can’t hope to get enough new cards with sign-up bonuses in a month to support even a few days of six-figure spend. So, the percentage of your profit from sign-up bonuses becomes small, and to an extent unimportant because the proportion of them that you can earn relative to your spend is negligible.

What’s Your Point, Poindexter?

When offers like 99 bonuses of 15,000 Membership Rewards for $4,000 spend come around, several readers typically ask me why anyone cares. The question usually means that the reader hasn’t developed a huge manufactured spend volume, and that’s ok; not everyone wants or needs to hit that volume to be successful. If they do however attain big volume, then the reason becomes instantly clear: it’s a way to increase your return on large spend that’s repeatable 99 times, or maybe even 99*n times.

Have a nice Tuesday friends!

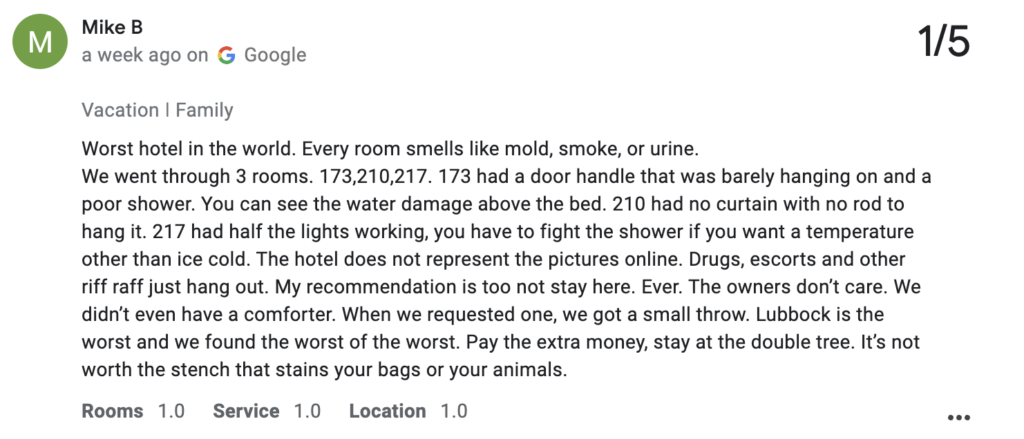

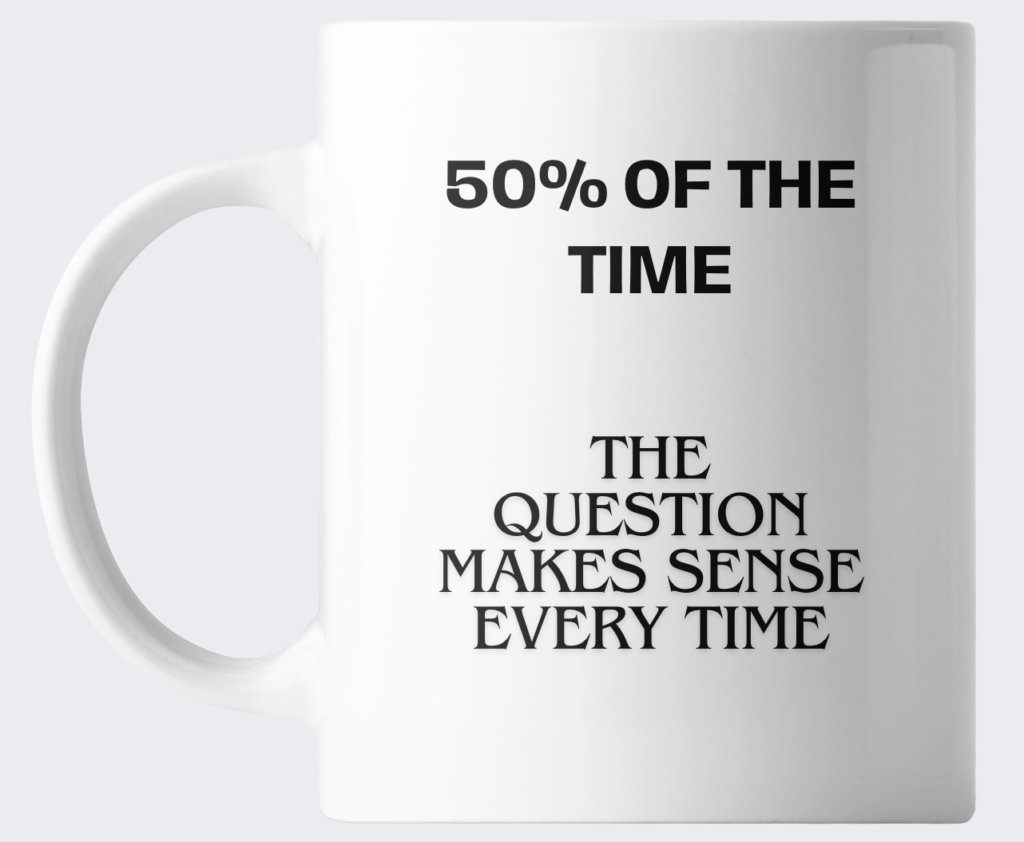

The MEAB Tuesday morning coffee mug.