EDITORS NOTE: In 2024, I’ve introduced Guest Post Saturdays. Today’s guest post is the second post in a series of at least two from the witty, inspiring, and definitely-not-a-giga-chad irieriley, his first post can be found here.

When to share the wealth

My grandfather was a gregarious man who loved more than anything to pass life advice down to his grandchildren. A lot of it centered around outlandish ways to get noticed in the job search (he once told me to send a pineapple with my resume inside to a hiring manager), but he also loved advice in the form of a good adage. His all time favorite is one we’re all familiar with: “irieriley, there’s no such thing as a free lunch.”

We’ve all accepted this as the truth, although MS and travel hacking allows us to get a consistent 90% off lunches, provided you are ready to decide on what you want to eat 355 days in advance. Therefore, it’s only natural to want to share this steep discount with family and friends.

Chances are, you’ve long been known as the “points expert” among your friends group and family. In my case, it’s so extreme that it’s generally the sentence after explaining my relation to the bride and groom in a wedding party bio.

And who can blame them? They see you agonizing over the choice of the Western or Japanese menu on ANA first or relaxing in the “base room” aka “bigger than a McMansion” at the Waldorf Ithaafushi and decide they want in on it.

However, most bright-eyed travel hackers aren’t going to hit the SUB on their first card, achieving breakage just like your favorite coupon book vendor intended. So, how best to set others in your life up for success? Here are some strategies that have worked well for me:

Provide starting direction

Not everyone is cut out to get super deep into the game, and that’s completely fine. There’s a plethora of reasons why it makes sense to target a SUB or two max a year. And thanks to the generosity of Chase and Amex, there’s generally always an elevated offer worth going for when your coworker Slacks to ask what card to get.

It’s a perfectly even exchange – you help people get a couple of free flights a year, and in return, you get fodder for Frustration Friday when they forget to use your referral link.

Add a partner in crime

Because of the collaborative nature of the hobby, helping your friends and family with the savvy to handle it can be a win-win.

I have a friend that I knew could make it as an advanced travel hacker, so I gave her some helpful hints a few months ago. I couldn’t be more proud of her progress, as she dove in head first and has already redeemed RT tickets to Asia for her and her P2.

If you have friends or family that can handle it, you’d be surprised how nice it is to have someone you know IRL to swap stories with.

Add P3, P4, P5 and so on

Most MEAB readers that are in a serious relationship likely count their significant other as their P2, since miles and points can be earned quite easily without all that much active participation.

It doesn’t need to stop there – some of us are earning and burning for much more than 2 players. This is more complicated than helping a friend and is a better fit for immediate family since it requires SSNs and financial trust, but it’s an amazing way to spread the wealth for those that have the time for it.

For what it’s worth, my P3 and P4 get stressed out about opening cards or the idea of MS, but they sure weren’t stressed when they flew Emirates first to Milan.

Book for them

For the truly advanced (or truly risk averse) earners out there, you can sidestep involving your loved ones in your shenanigans entirely and just let them enjoy the spoils.

Being able to treat family and friends to shared bucket list adventures or arrange emergency flights and hotels in a pinch are truly the most fulfilling way to use points.

This option can also be fantastic for things like group travel with your friends – a multi bedroom Vacasa is no big deal even post-devaluation when you’re earning 8x Wyndham on all of your “gas purchases”.

I’ll end by channeling my late grandfather with an adage – teach someone to use TPG referral links, and you’ll feed them for a day. Teach someone to responsibly MS, and you’ll feed them forever.

– irieriley

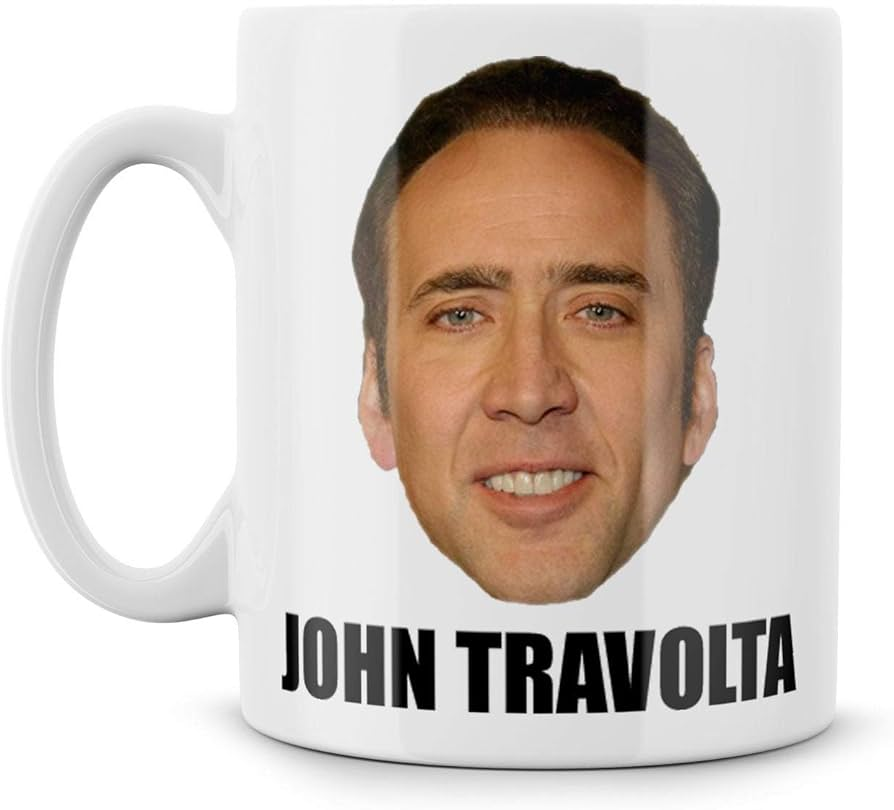

Pictured: DALL-E’s nightmarish rendition of my grandfather and I preparing the well regarded ‘resume in a pineapple’ method of standing out in the job search