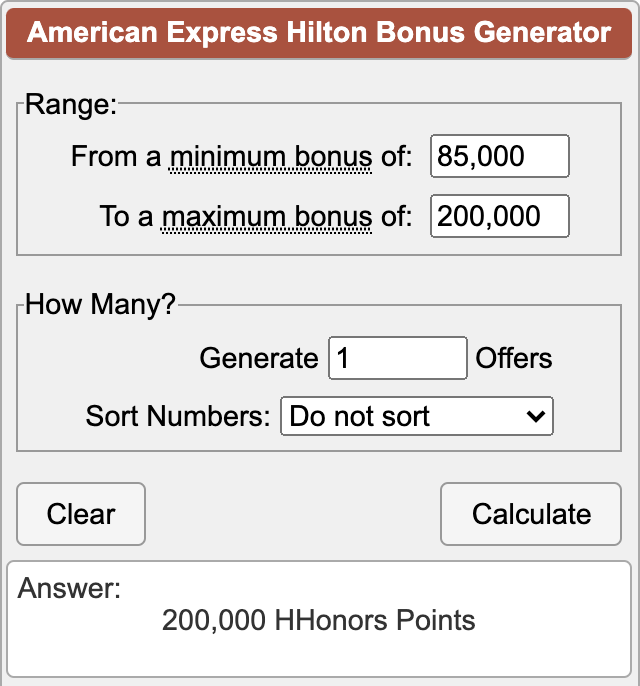

If you have an American Express personal card, or a bunch of them like me, today is a great day to give them a call or chat with them online and ask for a retention offer. In the last week I’ve been offered or seen widespread offers for:

- 50,000 Membership Rewards on the Morgan Stanley Platinum, Schwab Platinum, and some regular Platinums

- 30,000 Membership Rewards on the Gold and on some Platinum cards

- 20,000 Membership Rewards on the Everyday Preferred

- 50,000 Skymiles on the Delta Reserve

Conversely, the other co-brand cards seem to be offering nothing but a wasted couple of minutes on the phone. As always, YMMV though.

My usual language is “I’m thinking of closing this card due to its high annual fee, but before I make a decision, I wanted to see if there were any spend bonuses or retention offers available.” If there’s no offer and I want to keep the card anyway, I’ll usually say “Hmm, I think I’m going to think about it some more and call you back later.” Sometimes there are multiple offers too, so after being presented with one offer, it never hurts to say “Hmm, are there any other offers?”

Obligatory caution: If you take an American Express retention offer, keep the card open for a year to stay in their good graces. You can get retention offers with American Express at any point during your card member year, but I like to wait until the annual fee posts since cancelling the card mid-year usually won’t offer a pro-rated refund (except in Massachusetts, go Sox I guess). Big bonuses like this make me second guess that strategy though.