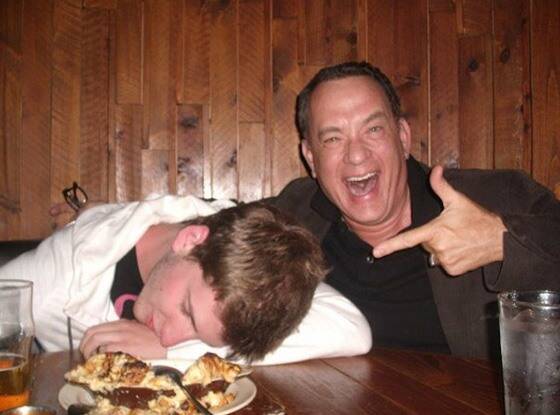

End of month housekeeping has turned into an American Express show. The new MO over there seems to be to offer as many benefits tied to the calendar as possible. They count on most people not using the benefits (breakage) to boost the marketability of the card and to subsidize the few that take advantage of the benefits. Be one of the subsidized in this case, not the subsidizers. I’d suggest you be like Tom Hanks and check the following:

1. Make sure you’ve spent any American Express credits in Uber Eats or Uber by Monday night. The holiday weekend should make this one easy on the Eats side.

2. Check for any credit cards that have had annual fees post this month and call the bank for a retention offer. I suggest saying: “I’m thinking of closing this card given its high annual fee, but before I decide what to do I was wondering if there are any retention offers or spend bonuses.” You’ll earn 100 MilesEarnAndBurn bonus points if you add “COVID has made it really hard to use the benefits, I wish it would end soon”.

American Express specific caveat: If you take a retention offer, plan on keeping that card for 12-13 months to avoid getting popups that deny credit card bonuses in the future.

3. If you have an American Express co-branded personal card (Marriott, Delta, Hilton), make sure you’ve attached the dining offer to your card and that you’ve spent it by Monday night. The easiest way to do this from home is to buy an exact value DoorDash gift card on Fluz. Amazon Meals is another decent option. As always, find a Fluz referral from a friend to make their day if you don’t have an account already, they’ll earn something and so will you.

4. Spend any American Express co-branded business card wireless credits before Tuesday, but make sure you’ve added the offer to your cards first. I prepay my cell phone bill with this one, and at this point I’m prepaying into 2022.

5. Make sure you’ve spent any $10 American Express Personal Gold dining credits by tomorrow. My go to is the local coffee shop; a couple of lattes and a muffin jump just north of $10 on GrubHub. Not personally, but I know ShakeShack works for a lot of you.

6. Cancel any cell phone burner accounts that you’re done with (and for which you didn’t use a virtual credit card number that already expired).

7. Spend your AmEx Personal Platinum $30 PayPal credits. The easiest way to get these out under the wire is with PayPal Digital Gifts which has been paying the credit even though the T&C says that it shouldn’t. If you’re set up as a gift card reseller, you can alternatively buy gift cards for resale on Fluz or eBay gift cards on Slide. This benefit goes away after June, and honestly that’s not a moment too soon. I’m sick of dealing with it.

8. The time remaining for Q2 bonused spend is already two thirds over. Check the current Q2 categories and reassess your strategies. Hopefully on the Chase Freedom side you were able to knock it out at Lowe’s.

9. If you’ve got the time, look for a nice miles & points related podcast. There are a few good ones out there and they’ll boost your skills and learning.

Have a nice holiday weekend, and grill until you drop (or something).