- Today is the last day that the American Express Business Gold card has a $295 annual fee. If you’ve been slacking on a product change or a new application and that slacking extends past tonight, it’ll cost you an extra $80. A few notes:

– If you’re going to apply head on, don’t forget that you can probably get a much better offer by trying several browsers and connecting to a Dallas VPN

– If you can’t find a better offer through a VPN, at least use a referral link

– If you triple dipped Business Platinum cards in December 2022, a downgrade might be a better option than closing the card given the current lack of no-lifetime language (NLL) links

– American Express’s calendar day ends before midnight Eastern, but after midnight UTC, because reasons

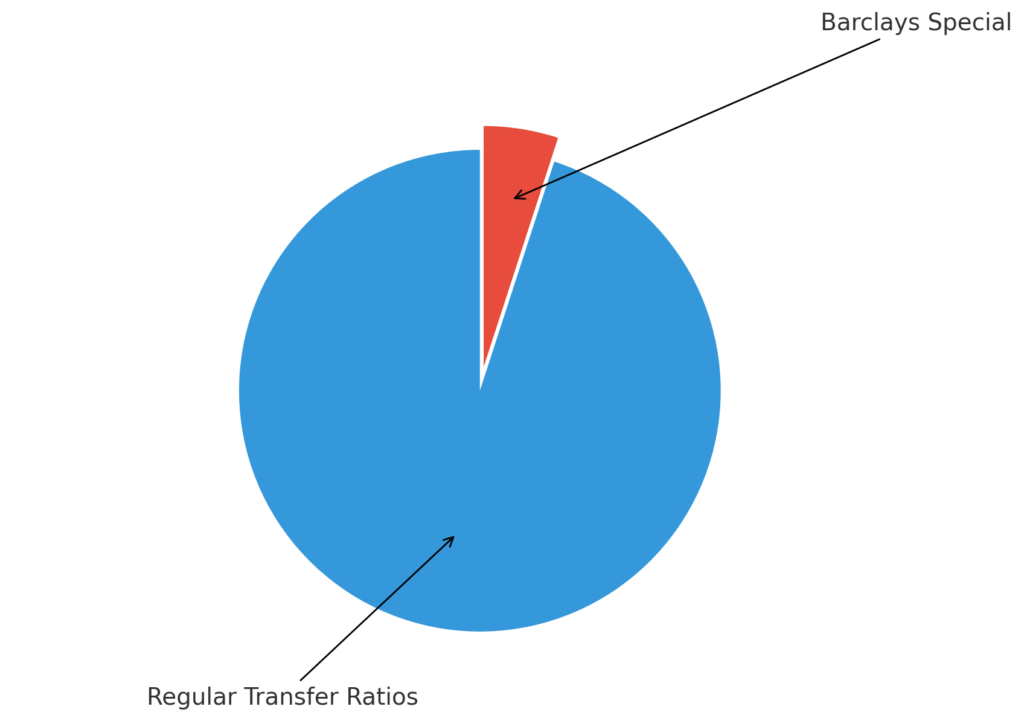

The Business Gold card also has an unadvertised spending bonus (of sort) via phone in employee offers or via online employee offers, and now has $240 in annual office supply credits. - Southwest has 50% off of flights to and from Denver or Colorado Springs booked by tomorrow night with promo code SAVENOW for travel between February 20 and May 22.

As is typical with targeted promo codes and Southwest, there are a bunch of excluded days and routes, most of which correspond to the days that normies working with school schedules want to travel. - Do this now: Register for Best Western’s Q1 promo for 5,000 bonus points per stay for up to 10 stays through May 5.

Look, I’m not planning on staying in a Best Western either, but sometimes it’s the best option and in case that happens the promo will already be attached to your account.

Have a nice Wednesday!

You shouldn’t could combine the second and third items at the Best Western Movie Manor (pictured).