- Do this now (for Marriott Bonvoy Ambassadors and Titaniums): Register for United and Marriott’s reciprocal earning:

– 1,500 Bonvoy points and 1,000 United MileagePlus miles for a stay after August 31

– 500 United MileagePlus miles per stay at Marriott properties

– 750 Bonvoy points per United flight

Afterward for masochists, consider how many United flights you’d have to take to earn a free night at a Marriott Courtyard. - The Citi Shop Your Way Rewards Mastercard, the Paris train system of credit cards, has new beginning of the month spend offers:

– $125 statement credit with $750+ spend or $200 statement credit with $1,500+ spend monthly in gas, grocery, or restaurants through December

– $100 statement credit with $500+ spend or $150 statement credit with $1,000+ spend in monthly in gas, grocery, or restaurants through December

Those who didn’t have that type of offer seem to already have a prior monthly version. (Thanks to Peter, bktran, TeddyH, and K). - The Chase Sapphire Reserve personal card has updated its Pay Yourself Back categories for Q3. Grocery, gas, home improvement, and annual fees will be reimbursed at 1.25 cents per point, and select charities at 1.5 cents per point.

The Sapphire Reserve business card only has charities as an option, and only at 1.25 cents per point. At least you still can buy a $50 Lululemon gift card for free twice a year I guess, which works out approximately 0.63 pants per year. - American Express offers has a new offer for 20,000 Membership Rewards or a $200 statement credit after $1,000+ spend with AirFrance / KLM.

Yes, it’s not hard to hit this offer with a family traveling to Europe. But also, it’s possible to hit it in less obvious ways. - The American Express Delta Business cards have no-lifetime language (NLL) links that match their recent normal link heightened sign-up bonus:

– Business Gold: 90,000 SkyMiles after $6,000 spend in six months, waived annual fee

– Business Platinum: 100,000 SkyMiles after $8,000 spend in six months

– Business Reserve : 110,000 SkyMiles after $12,000 spend in six months

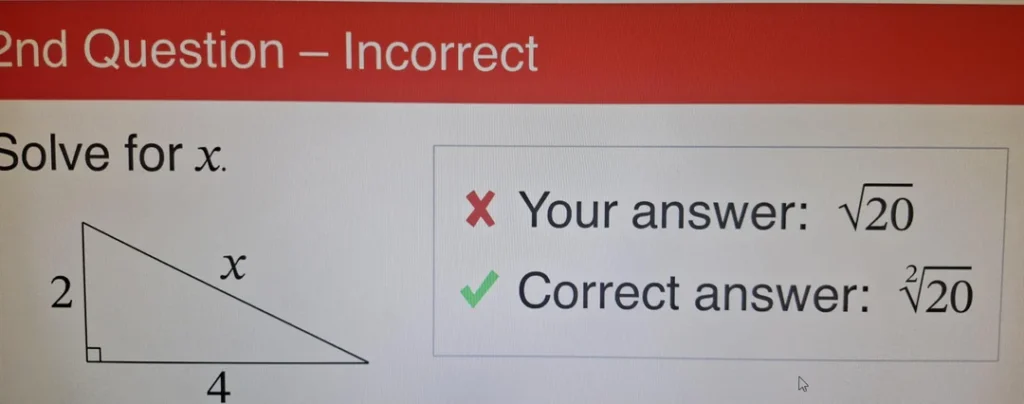

The personal cards still have regular lifetime language in their offer terms. - American Express Membership Rewards will reduce the transfer ratio to Emirates Skywards on September 18 from 5:5 to 5:4. Or if you prefer, from 225:255 to 225:180, because math is fun (or at least it’s “fun”, idk).

- AirFrance / KLM FlyingBlue has released its July promo rewards for travel through December 31. US cities in this month’s promotion are: Portland OR, Austin TX, Atlanta GA, and Dallas TX.

Economy flights are 18,750 miles and business class are 60,000 miles each way.

Happy Wednesday!

Math is just as “fun” for computers as it is for us.