EDITOR’S NOTE: Today’s post is a Friday guest post in a short summer series running on Fridays while I’m traveling. Today’s author is irieriley, a manufactured spend gigachad who’s been featured on the blog multiple times in the past.

One of the most exciting parts of this hobby is the emergence of a new play. When you find something, especially if it’s particularly lucrative, it’s tempting to start scribbling some ballpark math on the back of a cocktail napkin.

After all, you need to start planning what color of Lambo you’re going to buy when you hit this play every day to the deposit limit for the next year straight. There’s no way this play won’t last forever, right?

Unfortunately, nothing actually lasts forever in manufactured spend (MS) and plays die without warning. For example, a growth stage fintech that lets you make “kalls” on election results will quickly wonder why they are paying so much interchange (and how “debit cards only” didn’t actually apply) to users that aren’t profitable.

Even archaic financial institutions founded in the 1800s will eventually have a Western region VP of accounting realize they’re absolutely hemorrhaging money.

Knowing that lucrative plays have a finite lifespan from the second they’re discovered, here’s my advice. Outside of very rare situations (i.e. causing a shutdown at Amex or your primary hub, and also, don’t break the law, for obvious reasons), you will regret not going hard on a target vs. pacing yourself, trying to keep it alive long-term.

You may not be hitting it hard, but whales, miracle doctors, and their small army of players are, and you’re collateral damage. Make your money, accept the shutdown because you aren’t a profitable customer, and move on (hopefully with an increased balance that matches your napkin optimism).

I speak from experience on counting my chickens too early. 2 years ago, I did some napkin math on profit based on maximizing employee card slots across Amex charge cards for myself and P2, since we had been targeted for them a ton in the months preceding. Guess who has virtually never been targeted to add ECs since that exercise?

I ended up making more money that year than my napkin math suggested, through entirely different plays. And yes, those plays are all dead now, too. But as my P2 loves to say, “there always seems to be a new scheme around the corner when you’re sad about one dying”. Stay frosty, my friends.

– irieriley

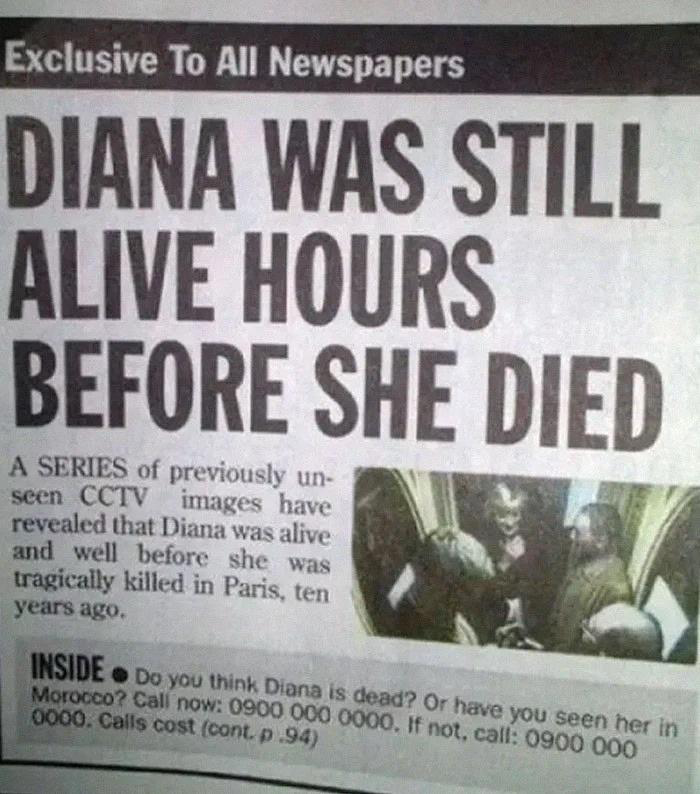

Pictured: a whale opening the gullet to inhale 100k lbs of chicken, er, krill.