Introduction

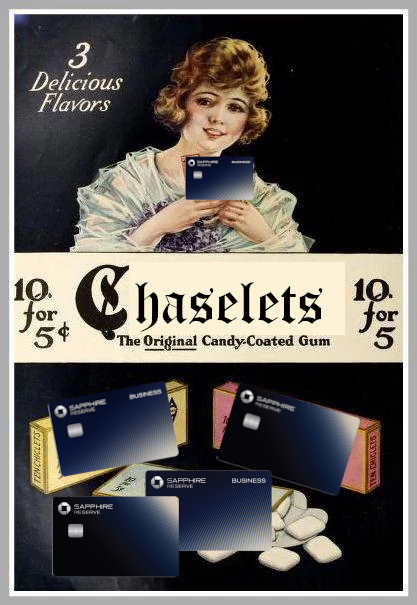

How unlucky do you have to be to have the credit card community learn about your new credit card on the same day that the Chase Sapphire Reserve marketing blitzkrieg kicks-off? At least 17 unlucky units by my calculation, which happens to match Crypto.com’s luckiness as measured with my science-o-meter.

The Card

Luck notwithstanding, Crypto.com launched a Visa credit card issued by Comenity bank with tiered “cash-back” rewards, and those tiers are based on how much crypto you’re staking. For turbo crypto newbies, staking basically means loaning your crypto to others which locks you out from trades while your crypto is on loan, and the staking for this card requires you to lend for at least a year. The staking requirements and tiers for the card’s bonus and cash-back are:

- $0: 1.5% cash back, $100 bonus after $1,500 spend in 90 days

- $500: 2.5% cash back, $150 bonus after $2,000 spend in 90 days

- $5,000: 3.5% cash back, $500 bonus after $5,000 spend in 90 days

- $50,000: 5.0% cash back, $1,000 bonus after $10,000 spend in 180 days

- $500,000: 6.5% cash back, $25,000 bonus after $25,000 spend in 180 days

Those numbers look great, except a few things:

- Crypto coins behave a lot like stock, they can go up or down in value at any point

- Staking your coins effectively locks them up for a year, giving lots of time for value to change

- The price of the coin you’d be staking in, CRO, is very volatile

- CRO’s price is down 60% from December, not a great trend

- Cash back from spend is on this card is actually a lie, you earn CRO on your spend

- You could stake your crypto elsewhere and earn a return directly from staking too if it weren’t tied up with the card

- Crypto.com rug pulled with their own tokens in the past

- Crypto.com’s compliance team for their prior version of their credit card were hawks, though that was Community Federal Savings Bank and not Comenity

In theory you could mitigate some of these concerns with hedged derivatives trading on CRO, but US traders are effectively locked out from (relatively speaking) safer markets for doing so.

The Gamble

Now, let’s think through some of the potential losses if we gamble on this card:

- Your CRO may lose some or all of its value

- Comenity may not like the kinds of transactions that we do and prevent you from earning on spend

- There’s opportunity cost in staking

Finally, let’s assume that your staked crypto loses 30% in value during its lockup period. How much will you have to spend at each tier to cover that loss with the increased bonus percentage (ignoring the modest sign up bonus)?

- $0 staked → $0: Obviously, this is all gravy at 1.5% cash back

- $500 → $350: Spend $15,000 to break even versus nothing staked

- $5,000 → $3,500: Spend $75,000 to break even versus nothing staked

- $50,000 → $35,000: Spend $428,571 to break even versus nothing staked

- $500,000→$350,000: Spend $3,000,000 to break even versus nothing staked

So it’s clear that if you’re going to gamble with an advantage, either you’d better have good confidence that you can get a lot of spend through without issues, or you’d better believe that CRO isn’t going to lose value.

If that weren’t bad enough, there tolerant cards from other issuers that earn 2%-2.625% on general spend and maybe more with the right payment types, so your opportunity cost looking outside of the Crypto.com ecosystem is real.

Tl;Dr

Opportunity cost is real, crypto is volatile, and crypto.com has rug-pulled before. It still might be a great card, but I doubt it.

Happy Tuesday!

A hat that guarantees its wearer will be left alone in public.