About two weeks ago, several popular travel bloggers dropped hints about visiting a corporate sponsored affiliate meeting from a company named Mesa. Since then I’ve been expecting a deluge of articles about their newly launched card, but for the most part nothing has appeared. Why? I assume news is embargoed until Mesa says it’s ok to write about it, preferring to soft-launch in relative quiet with a waitlist and then go big at just the right time™. On the other hand though, you know what they say about assuming.

Anyhoodles, since I’m under no embargo and I guess I don’t care about soft versus full launch, let’s discuss the rewards system and the waitlist credit card in a no-quid-pro-quo kind of way. It’s a lot like Bilt in that there’s a way to earn points whether or not you have the card, but you can earn more with the card. It’s unlike Bilt in that its VP isn’t telling people how to game their own company, or seemingly lying about being an industry-first program to launch earning on mortgages.

Earning

Whether or not you get the card, you’ll earn a point for each dollar when you originate a new primary loan or a refinance an existing primary loan, as long as you use a “The Mesa Mortgage Marketplace Lender”, which I guess we’ll abbreviate as TMMML because reasons. You can do that up to five times per account too.

But, how good are those TMMMLs? Well, when I put in my address, I got a single option: Swift Home Loans Inc which is apparently a mortgage broker based out of Birmingham; but not that Birmingham, it’s the Michigan one. So I guess there’s exactly one TMMML (at least for my state) and they’re rated 2.8 out of 5 on Facebook. I dialed their main contact number to ask about which banks they work with and what sorts of mortgages they can handle, but it just rang for a good minute so I hung up. Looking pretty great guys!

How about the credit card? It’s a Visa issued by Celtic bank and carries no-annual fee. The earning structure:

- 3x on HOA fees, contractors, homeowners insurance, property taxes, home decor, and other “home-related” charges

- 2x on gas, groceries, EV charging, and utilities

- 1x on a linked mortgage, but only on up to $100,000 in mortgage payments annually

- 0x on other spend, as far as I can tell

- Free Sam’s Club membership

Like with Bilt and rent, you don’t need to put your mortgage payment on a card to earn points on mortgage payments.

Burning

There are two options for redeeming Mesa points: booking travel through their portal, and gift cards. The cash value of each, based on my sampled searching:

- Travel: 1.0 cents per point, but also a fixed 400 point extra surcharge per flight

- Gift cards: 0.7 cents per point

Everything Else

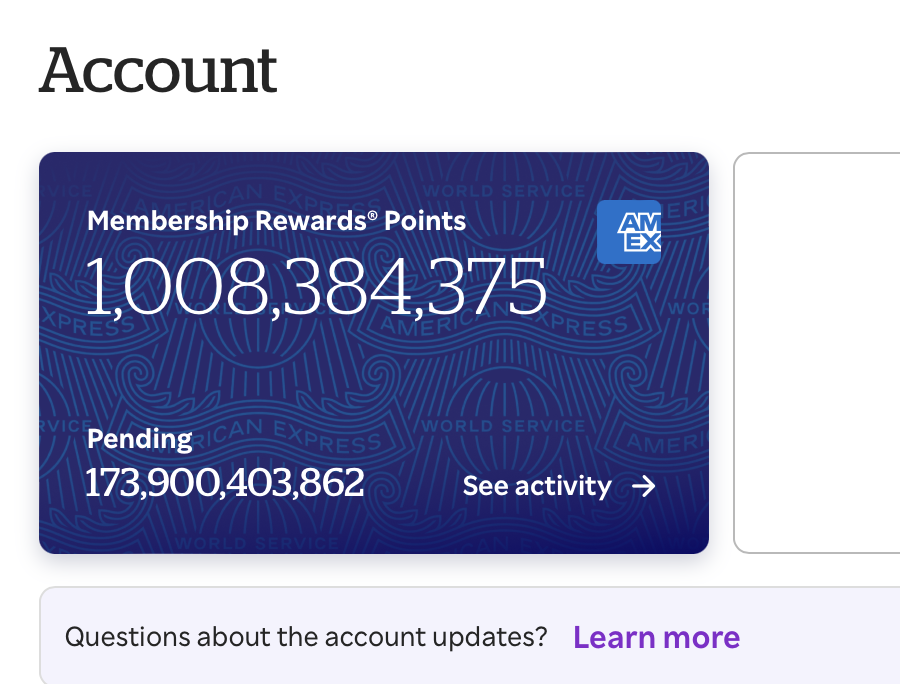

Here’s how I’d look at this card, considering that if you’re booking travel through a portal you’re not going to use Mesa because Chase and AmEx have much better value propositions:

Gift card options include popular bulk brands like BestBuy and Apple, and assuming a resale rate of 93%, that means you can cash-out your points through gift cards at 0.65 cents per point 🤏. So:

- You earn 0.65-0.70% back on mortgage payments just by holding the card

- You get a 0.65-0.70% rebate on new mortgages, but those are probably baked into the fees of the one member of the TMMML

- You’ll do better for other spend, manufactured or real, with other credit cards.

Finally, I extracted the full terms and conditions of the rewards program from the mobile app in case you’re curious, and it’s just this webpage.

tl;dr: It’s ok I guess, but you can probably skip the dozens hundreds thousands of affiliate articles when they come out in (probably) the next couple of weeks.

Happy Wednesday!

Kick-off party for current members of TMMML.