- Do this now: Register for Hyatt’s promotion for 777 bonus points per night at casino hotels through September 30. (Un)fortunately, the dirty castle is no longer part of Hyatt’s portfolio and the Rio is a poor stand-in.

- Do this now: Make backup bookings for any existing Advantage car rental reservations because they may be in the midst of collapse.

- Staples has fee-free $200 Mastercards in store through Saturday, limit nine per transaction.

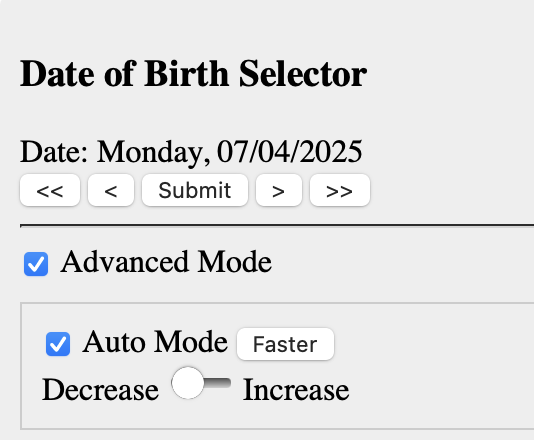

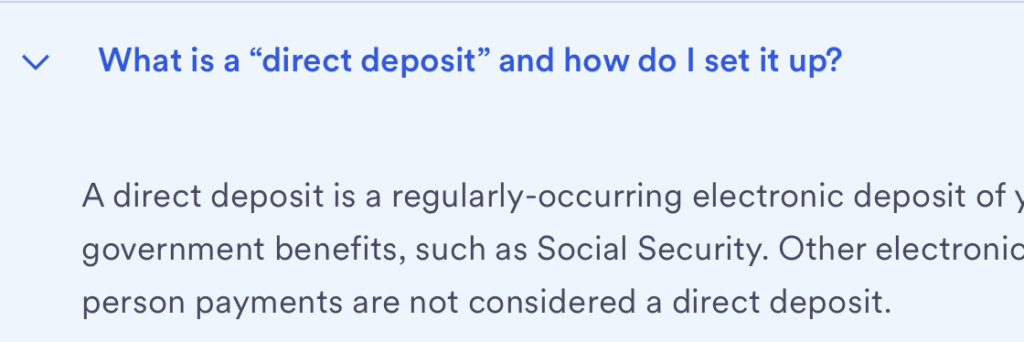

These are Pathward gift cards. - US Bank has a $450 checking bonus for new Smartly checking accounts with $8,000+ spread over two direct deposits, or over two “direct deposits”, the first of which has to happen in 30 days. This is mainly interesting for establishing a Smartly account for higher payouts on the related but different US Bank Smartly credit card.

If you’re not in US Bank’s footprint, opening a brokerage account first will get your foot in the door for other products. BiltBlit is losing their relationship with Wells Fargo in favor of Cardless with three tiers of cards in (probably) June 2026. After the transition, it’ll probably switch from the Mastercard network to the American Express network. Is that a net positive or negative? Depends on your game I suppose, but at least Cardless dropped its one card per lifetime rule.- American Express Offers has a targeted offer for $40 off of $200+ at Caesars through October 31.

Happy Monday friends!

From US Bank’s FAQ: Even they understand that direct deposits are often “direct deposits”