EDITORS NOTE: In 2024, I’m going to try and have a guest post on Saturdays. Today’s guest post is from the first manufactured spender I ever met up with in person and an original manufactured spend whale, Dean. Yes, Dean was really in Lubbock.

I recently had the opportunity to fly to Austin Texas and drive back to my home in Utah. When I reviewed the driving route, it passed directly through Lubbock, TX. MEAB is always talking about how Lubbock is his favorite destination so I thought this would be a great opportunity to see why he loves it so much.

I found the simplest points option for the flight to be Chase Ultimate Rewards to pay for the Delta direct from SLC to AUS through the Ultimate Rewards travel portal. Since it was a direct, morning flight I figured it would work for my tight schedule to pick-up the car before the shop closed and be on my way toward home in the afternoon.

A week before heading out, I reserved an Uber to pick me up at AUS to take me 1 hour and 15 mins away to Temple where the car was located. The flight was to arrive at 2:05PM, and an Uber ride of 1 hour and 15 mins would put me at the shop just in time for my 3:30PM appointment. It was a tight schedule but I figured the worst that could happen is that we would spend a night in Temple, TX and pick-up the car the next day with a couple more Uber rides.

Departing on this long drive at 4PM meant we would need a place to stay about 6 hours away so I wasn’t driving home drowsy. Low and behold, guess what was 6 hours away? Lubbock, TX. It was meant to be! Since Hyatt is still my favorite Hotel Points program, I was very pleased that I could stay at the Hyatt Place, Lubbock that MEAB so fondly refers to.

The Hyatt Place was about $98 per night plus taxes and fees. And this location is so fancy, they add a $7 a night parking fee. I outsmarted them with a Hyatt points reservation for 6,500 points and it apparently included the parking fee. They never charged me anyway.

Travel day came and all was well until, we sat on the runway for over 45 mins waiting for de-icing in SLC. That put us 30 mins late into AUS. I chose AUS hoping that the small size of the airport would make for a quick getaway and it worked quite well to move quickly through the terminal and into the parking garages. The signage for Uber was pretty easy to follow and they have a very organized waiting area in one of the parking garages for Ride Share.

Once off the plane, I checked my Uber app to verify that my ride was ready, they had my flight info so a late arrival shouldn’t be a problem right? Well, all I saw was that I had nothing scheduled in the app (even though the day before, I got a confirmation email from Uber) I dug through the app and didn’t see anything except under “Activity” I saw my destination address and amount paid as “$0 Failed”. I have over $200 in Uber credits in there from the good-old days of buying gift cards at Whole Foods, that somehow generated Uber credits too, so payment shouldn’t have been an issue.

How does Uber send me a confirmation yesterday stating that I’m all set and then today with no notice just leave me hanging? Ugh, don’t trust Uber’s reservation system apparently. I went to the Uber waiting area as I requested another ride. My new ride was there as I walked up to the spot and it cost $20 less than the reservation so that worked nicely. Now to get to Temple as fast as we can and hope they let me pick up the car late.

Driving from AUS to Temple, TX was just one strip mall after another of Applebee’s and Chili’s restaurants separated by rolling hills. Our Uber driver was great. She said that the Ride Share market is very saturated there so she doesn’t get a lot of rides.

My wife thought it would be fun to see the Magnolia “Silos” in downtown Waco that was nearby. We headed up there to see what the hype is about. This place was a little interesting. I think people go there as a tourist destination. We got there 30 mins before closing and there were a lot of workers and very few shoppers. We got a S’more’s cupcake from their bakery that tasted pretty good and walked the shops that had over priced Hobby Lobby items for home decorating. We probably should have gone to the DR Pepper Museum instead.

We hadn’t eaten all day so we stopped into a Torchy’s Tacos to try them since they were highly recommended by our friends who lived in Texas. The $5-6 tacos were pretty good. Two filled me up but I could have easily eaten another, I just didn’t want to wait for another and was eager to get to Lubbock, TX.

The highway went directly NW all the way to Lubbock. It was mostly just two lanes but the speed limit was 75. It was dark so I think it was just more rolling hills with small towns spread far apart the whole way. As we approached Lubbock, it was just like driving into Las Vegas. We could see the glow of lights in the dark sky indicating a city was near. That’s where the similarities ended.

Maps took us through a small town on fancy brick-paver roads that eventually lead to Hyatt Place! Lubbock was a pretty tired town but the Hyatt place and surrounding buildings were modern and clean. I was pleased as I entered the lobby to see that it was a very new and clean facility. The lobby was identical to my all-time favorite Hyatt Place, Moab. It was built in the same 2018 style and had the same Hyatt Place fresh-clean scent.

My wife’s Hyatt credit card gives her status enough that we got 2 free bottles of water! We headed up to the room and found it to be in great shape and very clean too. Everything was standard Hyatt Place quality and comfort. No wonder MEAB likes this place so much! Other amenities include a swimming pool, fitness room, and spacious lobby with computers and work stations.

The location must be near a Police station. We were greeted by sirens when we got out of the car and heard them periodically through the night. Far more sirens than I expected in a small town like that.

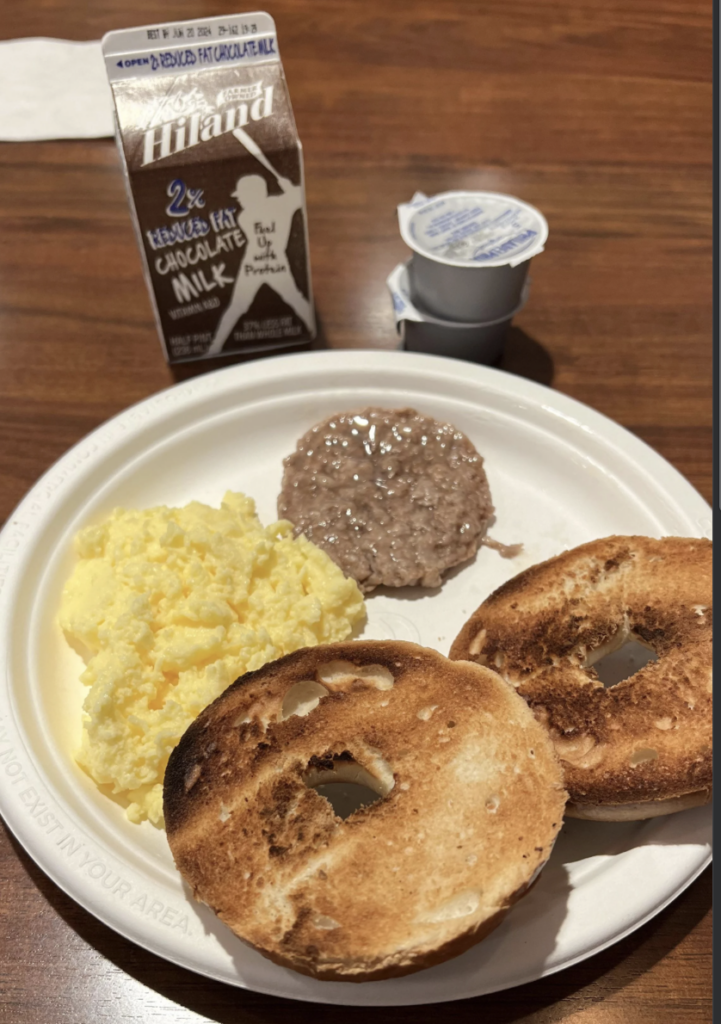

The free breakfast was standard for a, post-Covid, Hyatt Place. The shower supplies were the same smell and quality but in bulk large containers on the wall vs. individual containers that we have been used to in other Hyatt Places. The staff was friendly and we really enjoyed our stay overall.

We headed out for the rest of our adventure back to Utah well rested and fed. If I ever find myself near Lubbock, TX again, I would definitely stay at the Hyatt Place, Lubbock again. And so should you.

– Dean

The view from the Hyatt Place Lubbock’s window. Just kidding, the rooms’ windows only have a view of the dumpster.