- British Airways has a status tier match for US and Canada residents that hold elite status with Delta, Air Canada, Lufthansa, United, FlyingBlue, Scandinavian, or Virgin Atlantic. You can match to either:

– BA Silver, which includes oneworld Sapphire status

– BA Gold, which includes oneworld Emerald status

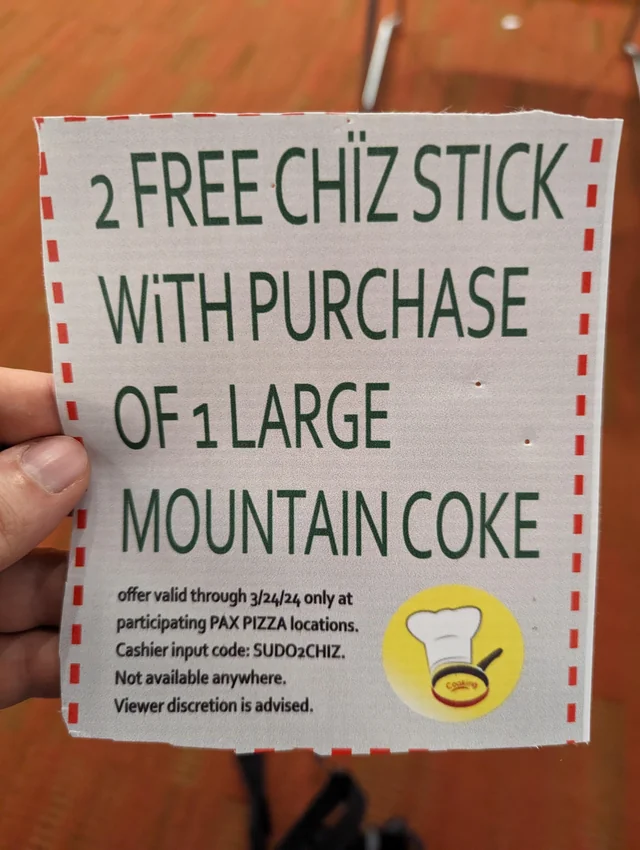

Your status lasts six months, and you have to apply by May 7. Both status levels get you access to AA lounges on domestic AA tickets, including Flagship lounges for you and a guest. Just watch out for the food in the non-flagship lounges, it’s unclear about whether or not it technically counts as food, even though it legally does. (Thanks to Connor) - Do this now: Check for Chase targeted Q2 spend bonuses on up to $1,000 in spend:

– Hyatt: 5x earning

– Marriott Bonvoy or Bonvoy Bold, or alternate link: 5x earning

– Marriott Boundless, or alternate link: 5x earning

– Marriott Bountiful, or alternate link: 5x earning

– Marriott Premier, or alternate link: 5x earning

– Ritz-Carlton, or alternate link: 5x earning

– United MileagePlus Select: 5x earning

– United MileagePlus Gateway: 5x earning

– United Quest, Explorer, or Club: 5x earning

– AeroPlan, or alternate link: 5x earning

– Southwest (all variants), or alternate link: 5x earning

– IHG One: 7x earning

There are other lesser carried card linkss like the old United Presidential Plus card, Disney card, or Amazon card, so check chase.com/mybonus if you didn’t see a link above for a particular card. (Thanks to FM) - The American Express Personal Gold card has an offer via referral for 90,000 Membership Rewards after $6,000 spend in six months, and it includes a 20% statement credit on restaurants for up to $250 in spend. Don’t forget to check for a 10x bonus offer on dining for the referrer too. (Thanks to InenvitableOk7737)

- Do this now: Register for double points at Accor Hotels in Europe and North Africa booked by May 12 for stays between May 27 and July 5.

Sample non-flagship AA lounge food. Hopefully the red parts are classy hotdog bits.