- American Express has new offers for 20,000 Membership Rewards after $4,000 in spend in six months for new employee cards, limit five per account for Business Golds and Business Platinums at last year’s generic links:

– Business Gold

– Business Platinum

The POID on these is K4IY:9976, and the offer has been alive for several weeks (first discovered by reader Jon via MEAB slack), but just hit mainstream yesterday. It’s also been out long enough that American Express customer service confirmed that the offers are properly attached. - Southwest has an airfare sale for flights to, from, and within California through the end of day today using promo code 29OFF. The sale:

– $29 fares one-way with requisite asterisks within California

– 29% off of fares on flights to or from California, also with asterisks

Travel is valid between August 15 and February 14, 2024 for the continental US, and there’s some availability early next year for Hawaii too. For bonus points, do some schedule research and parlay this sale into Thanksgiving travel. - JetBlue has $25 off of one-way flights and $50 off of round-trip flights using promo code FALLTRAVEL booked by this evening for travel between September 6 and November 15. Of course this one has a few asterisks too, because capitalism.

- Yes, earlier this week we reported that Kroger would have a 4x fuel points promotion on Friday, Saturday, and Sunday. That wasn’t incorrect, but Kroger is laughing up at us from hell by having an overlapping 4x fuel points promotion on third party gift cards and fixed value Visa and Mastercard gift cards between today and August 8.

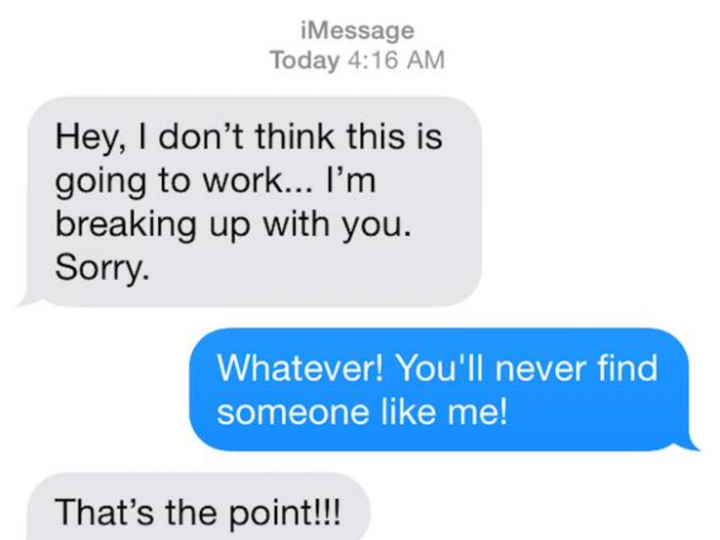

If you’re playing this game with AmExes, just watch out for certain purchases to avoid points clawbacks; remember it’s them, hi, they’re they problem it’s them.

The cable industry learned their asterisk game from the airlines.