Let me start today with a bit of advice: It’s easy to register for 5x promotions, and it’s also easy to hit all your spend in a single day. It’s also easy to assume that you’ll do it and then never get to it. So, consider setting aside a single day in early April to hit all your quarterly 5x spend so that you can focus on bigger, better deals.

- Do this now: Register for Chase Freedom and Freedom Flex Q2 5x categories. This time: Restaurants, Whole Foods (which sells many types of gift cards), and hotels.

- Do this now: Register for Discover IT Q2 5x categories. This time: Gas stations and home improvement stores, both of which sell many types of gift cards; also public transit.

- Do this now: Register for Citi Dividend Q2 5x categories: This time: Grocery stores and drug stores, both of which typically sell many types of gift cards.

- Do this now: Choose your US Bank Cash+ Q2 5x categories. I always choose utilities and electronics stores, the latter of which typically sells many types of gift cards.

- Giant, Martins, Stop and Shop, and Giant Food stores have 2x points on Vanilla Visa gift cards through Wednesday, limit $2,000 in spend per account, no registration required.

- Virgin Atlantic has a promotion for 50% off the mileage cost of award tickets booked by Wednesday for travel through June 30 for travel on Virgin Atlantic metal. This doesn’t reduce the often substantial surcharges that go along with the tickets. (Thanks to DoC)

- American Express offers has two new interesting card-linked offers:

– $50 off of $250 or more in spend at several IHG brands through June 15

– $150 off of $750 or more in spend at the Four Seasons through July 11 (if they do string matching, Four Seasons Total Landscaping may also work)

Gamers gonna game. (Thanks to DDG)

Have a nice weekend friends!

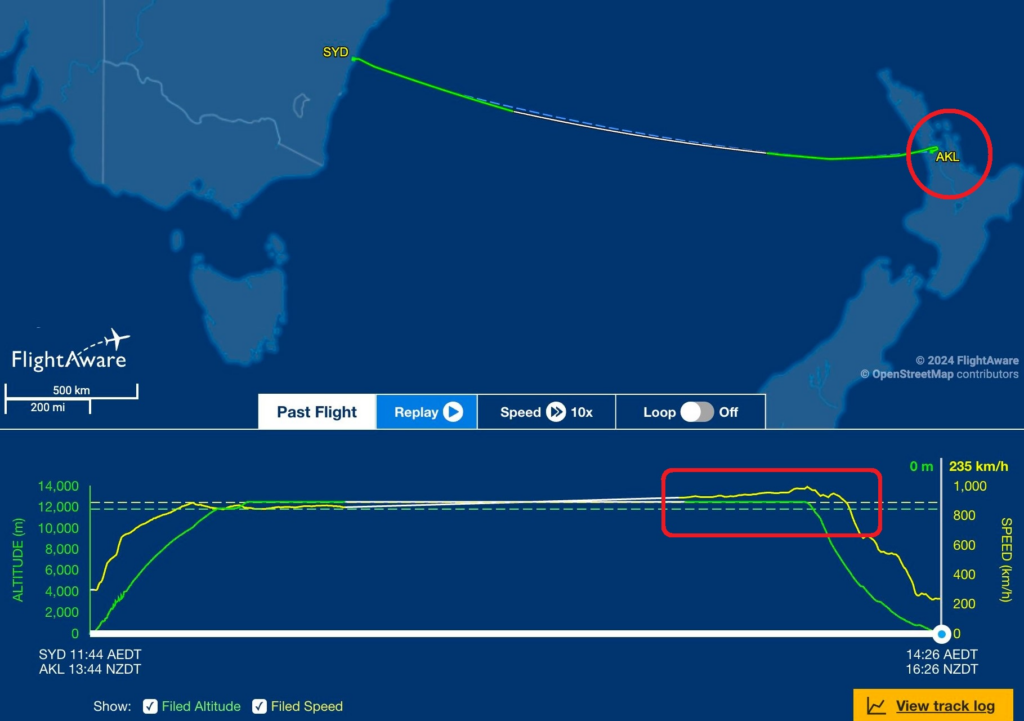

Not this kind of nose dive. (too soon?)