Introduction

I finally got a kick in the pants to write this post after Rocky emailed and asked why I keep talking about the Citi Shop Your Way Rewards card but haven’t ever posted any real information about it. Why haven’t I posted anything when I clearly love the card? Well, I guarantee you don’t want to know what’s going on inside my head at any given moment, so let’s skip the why and jump into the what. The what:

This no-annual fee card will pay you $700 or more a year, seemingly in perpetuity.

Vitals

This card is issued by Citi and is part of a cobranded relationship with Sears. Yes, Sears, the store that as of two days ago officially has no physical locations and was ransacked for billions of dollars in real estate by Eddie Lampert over the last decade.

- Issuer: Citi

- Type: Mastercard (512106 BIN)

- Rewards: SYWR Points or ThankYou Points

- Earn rate: 10 SYWR Points per dollar or 1 ThankYou Point per dollar

- Bonus categories:

- Up to $10,000 spend per year combined:

- 5x at gas

- 3x at grocery stores and restaurants

- 2x at Sears/Kmart/Hometown Stores

- Up to $10,000 spend per year combined:

- Annual fee: $0

- Sign-up bonus: $40 after spending $50 (but YMMV on whether that auto-posts)

- Affiliate-free application link

I think it’s obvious to about everyone in the known universe that if you could choose to earn ThankYou Points or Shop Your Way Rewards, you’d choose ThankYou Points. Unfortunately, the only way to get the ThankYou Point version of the card is to call in and ask to convert your Shop Your Way Rewards earning to a ThankYou Point earning version, but I haven’t heard of anyone having any success doing that since 2020. So, if you’re like me, you’re probably going to be stuck with the Shop Your Way Rewards version.

What do you do with Shop Your Way Rewards? You can redeem ten of them for a penny toward merchandise like toilet paper, iPads, or neoprene dumbbells at shopyourway.com, or you can cash them out for a gift card to resell. I definitely do the latter.

Value

Here’s why this card is really valuable: After you’ve had the card for two to three months and it’s been sock-drawered, you’ll start getting spending offers in your email inbox and those offers stack. And unlike everything else about Citi and Sears IT, they post automatically every-time. For example, I have the following spend offers all running concurrently and all from within the last 30 days:

- $70 statement credit after spending $2,000 anywhere

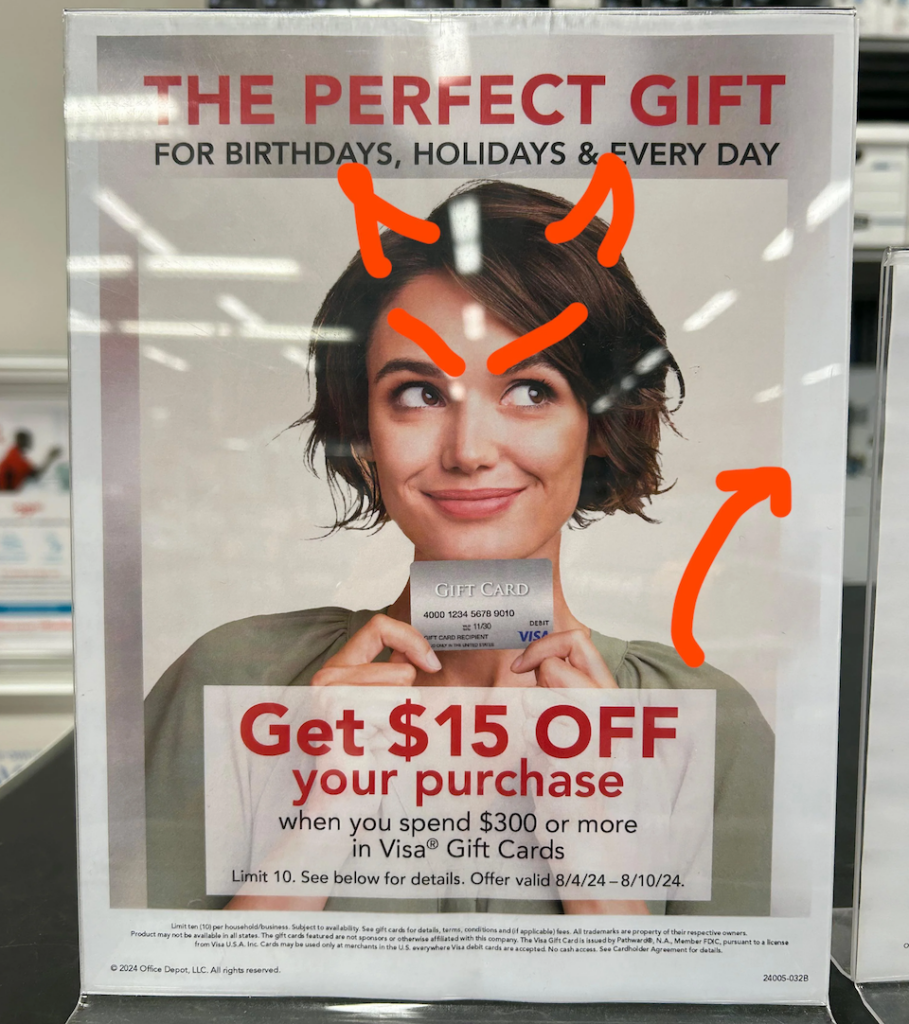

- 10x points at Best Buy (lol) and home improvement stores up to $1,250 in spend

- 10% back in statement credits on utilities every month through January 2022 (min spend $400, max earn $50 per month)

All of these offers obviously pair really well together. For simplicity, I’ll buy 3x$500 BestBuy gift cards at BestBuy for resale and send a $500 “utility payment”. After those two transactions I’ll earn $120 in statement credits plus another $125 worth of Shop Your Way Rewards points, all from a no-annual fee card.

And while not all months have offers stack as nicely as this month, it happens a lot. A lot.

MS Hint: This card is like other Citi Mastercards in many ways, but it does a few things better than other Citi cards too so don’t forget to probe.

ZOMG Wha??

Circling back to the introduction: this no-annual fee card will pay you $700 or more a year through targeted spend offers. Why? The rumor I’ve heard is that the Sears Shop Your Way Rewards card is one of the most valuable cards in Citi’s portfolio because it’s typically held by older generations that grew up with Sears, and those cardholders typically carry a monthly balance which earns Citi plenty in interest and fees so they want to encourage more spending and bigger balances. The story sounds truthy, but I have no independent confirmation so let’s just call it a likely possibility.

How come you haven’t heard of this card before? Well I’m sure the main reason is Sears, though I don’t think it pays a commission to affiliates so there’s not a financial incentive to write about it. Finally, the Shop Your Way Rewards program isn’t exactly on-par with AAdvantage or Hyatt, so there’s that.

(Special thanks to Garth for introducing the card to me.)