In case you hadn’t heard before now (maybe you didn’t read this post’s title), Virgin Atlantic announced yesterday that they’re joining SkyTeam. What that probably means:

- Delta award availability will get better, but cost more (#bonvoyed)

- ANA, Singapore Airlines, and Air New Zealand award redemptions will go away since each of these airlines is in Star Alliance, a SkyTeam competitor

- Virgin Atlantic award availability will probably get better for SkyTeam partners

- The 50,000 Virgin Atlantic mileage redemption for Delta business class to and from Europe loophole will likely be closed

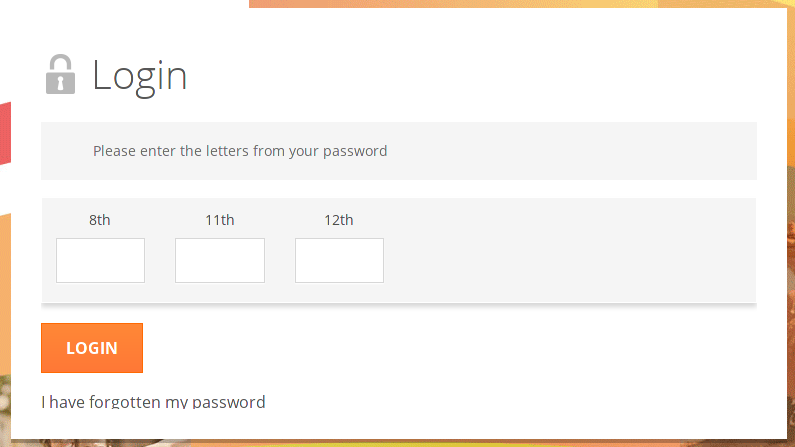

As a result, I’d do the following, and do it quickly:

- Book any ANA business class or first class round-trip awards to Japan and South Asia now, especially since Japan is opening on October 11. At 90,000-95,000 points round trip for business class, and 110,000-120,000 points round trip for first class, it’s hard to find a better redemption in any program

- Book any Delta business class award tickets to and from Europe right away, again assuming that you can find availability

- Book any Air New Zealand awards to Australia and New Zealand right away, also assuming you can find any availability

Don’t forget that American Express has a 30% transfer bonus for Membership Rewards to Virgin Atlantic that runs through Friday. Good luck!

Act fast on V05 too. Soon you’ll lose access to use it a toothpaste and mouthwash.