- I usually avoid predicting anything other than general trends, but I made the mistake on Tuesday of predicting that Kroger wouldn’t have another 4x fuel points promotion until late October. Well, the Kroger overloads pointed at me and laughed because of course they did. So:

Kroger is having 4x fuel points promotion on Happy and Choice gift cards through October 3, and these cards can be converted to other brands like BestBuy or Home Depot. (Thanks to GCG) - Office Depot / OfficeMax has $15 off of $100 Uber gift cards in-store through Saturday, limit two per transaction. As usual, link your cards with Dosh and look for Chase offers before buying. (Thanks to DoC)

- Bank of America has a $1,000 business checking bonus through December 31 with promo code SSPCIS. To qualify, you’ll need to deposit $30,000 in new funds within 30 days and keep at least that balance until 91 days after opening. This is in theory a targeted offer, but it’s available online and that’s been good enough for past variants.

If you keep $30,000 in funds tied up for 90 days, you’re earning an effective APR of 13.3%. If you’re not part of the Bank of America Preferred Rewards, this is a nice jumpstart into the program too, which can turn a card like the Business Advantage Unlimited Rewards card into a 2.625% everywhere card after you get Platinum Honors status. - In the wake of yesterday’s post about compromised online accounts leading to gift card losses, multiple readers suggested getting a hardware key like a Yubikey or Titan Security Key to further lock down your accounts.

I’m embarrassed to say that I’ve had one of these sitting on my desk for over a year but never set it up. That changed yesterday though #betterlatethannever.

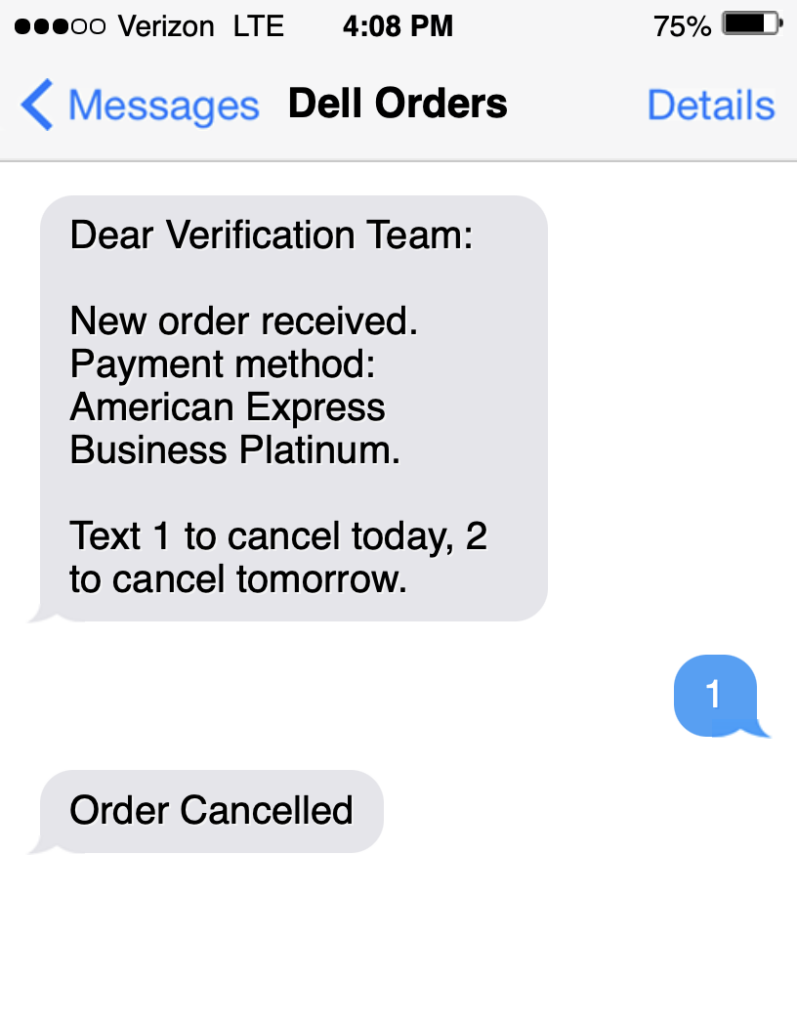

The unofficial MEAB shirt of the day.