- Staples will have fee-free $200 Mastercard gift cards starting Sunday and running through the following Saturday, limit eight per transaction.

Yes it’s possible to split payment at Staples and take advantage of the new American Express Business Gold monthly $20 office supply store credit, but you may get some side-eye. (Thanks to GCG) - The Chase Ink Cash and Chase Ink Unlimited cards have had a public 90,000 Ultimate Rewards offer for a few weeks, but it’s now also available via referral. The referrer bonus is currently 40,000 Ultimate Rewards, giving you a total bonus of [runs a program on a super-computer] 130,000 Ultimate Rewards in two-player mode.

As usual, use a P2 link or another friend’s link to make their day if you’re going to apply. (Thanks to FM) - Check your email for a targeted promotion from Visible for a free Orbic Myra 5G UW Smartphone. The email will have a unique promotion code and takes 100% off of the purchase price. Visible will unlock the phone after 60 days, and the resale value is well north of $200.

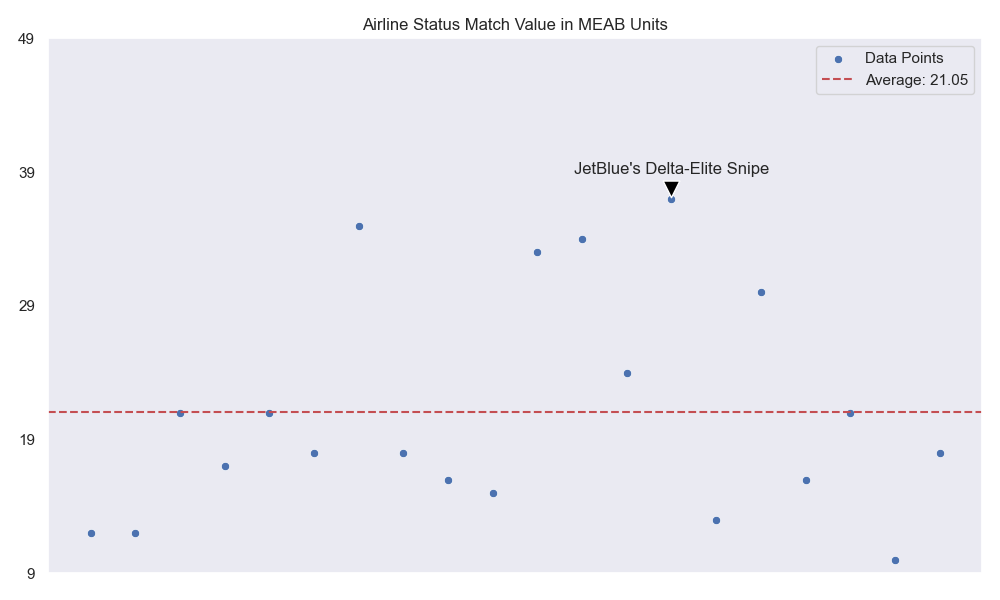

If you’re not sure why this is here at MEAB, see Cell Phone Burners. (Thanks to Bork) - Chase Ultimate Rewards has a targeted 25% transfer bonus JetBlue TrueBlue miles, but in general you really should think hard before transferring in because:

– JetBlue miles are worth somewhere around 1.3 cents per point

– Sapphire Reserve holders can book paid airfare at 1.5 cents per point

– Sapphire Preferred holders can book paid airfare at 1.25 cents per point

– Ink Preferred holders can book paid airfare at 1.25 cents per point

– Award tickets don’t earn miles when flying

– Paid tickets do

On the flip-side, playing games like booking yourself an extra empty seat don’t work with the Ultimate Rewards portal, so do what makes sense. I think the bonus is only present if you’ve already linked your JetBlue frequent-flyer account to Chase before today. (Thanks to dontcelebrate)

The mathematical average of a Staples clerk’s look after being asked to split payment on 12 Business Golds.