- United has 10% off of paid flights in the continental United States booked by July 24 using promo code TAKEOFF10 for travel from July 24 through September 26. This is a (widely) targeted promotion that will work one time if targeted for up to nine passengers on a single reservation, round-trip or one-way.

- Do this now: Link your Bilt and Lyft accounts in the Rent Day tab in the Bilt mobile app. You’ll earn a $10 Lyft credit if you don’t hold a Bilt credit card and $20 if you do. (Thanks to DoC)

- Smart & Final grocery stores have a promotion for a $10 off your next purchase when you buy a $50 Choice gift card through July 11. Choice cards can be converted to high resale value cards easily from home.

Usually you can’t use the $10 off coupons directly for another gift card purchase, but if you have a friendly cashier you may get away with it. (Thanks to GCG) - Kroger has a 4x fuel points promotion running through July 11 for third party gift cards and fixed value Visa and Mastercards.

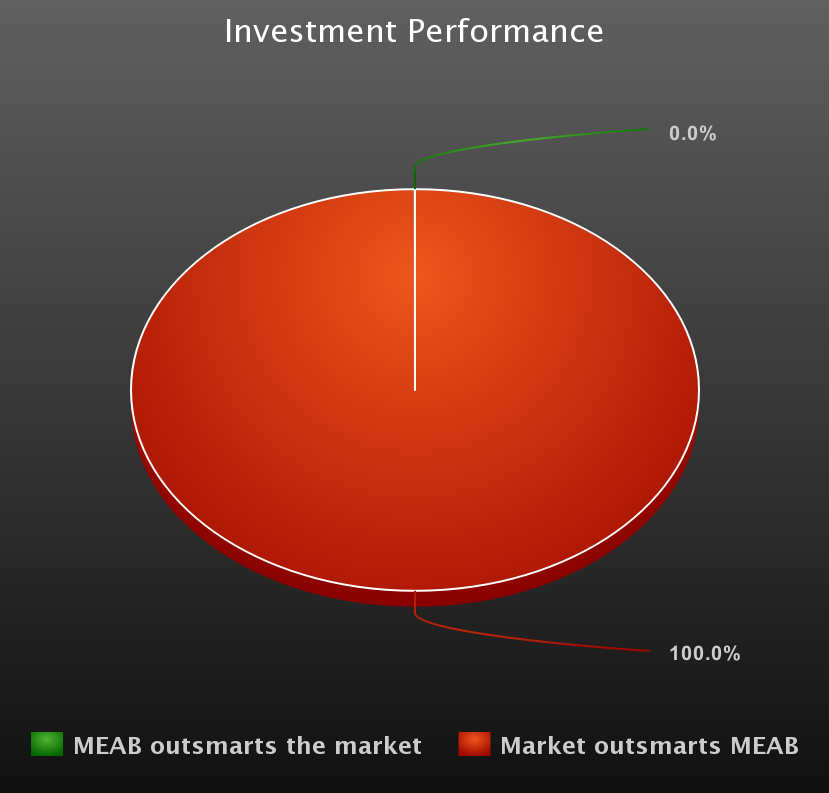

Kroger has taken a page from office supply stores and decided to run a gift card promotion more often than not running one, and that means that in the last two weeks and next two weeks we’ll have had exactly four days without a promotion. #slay

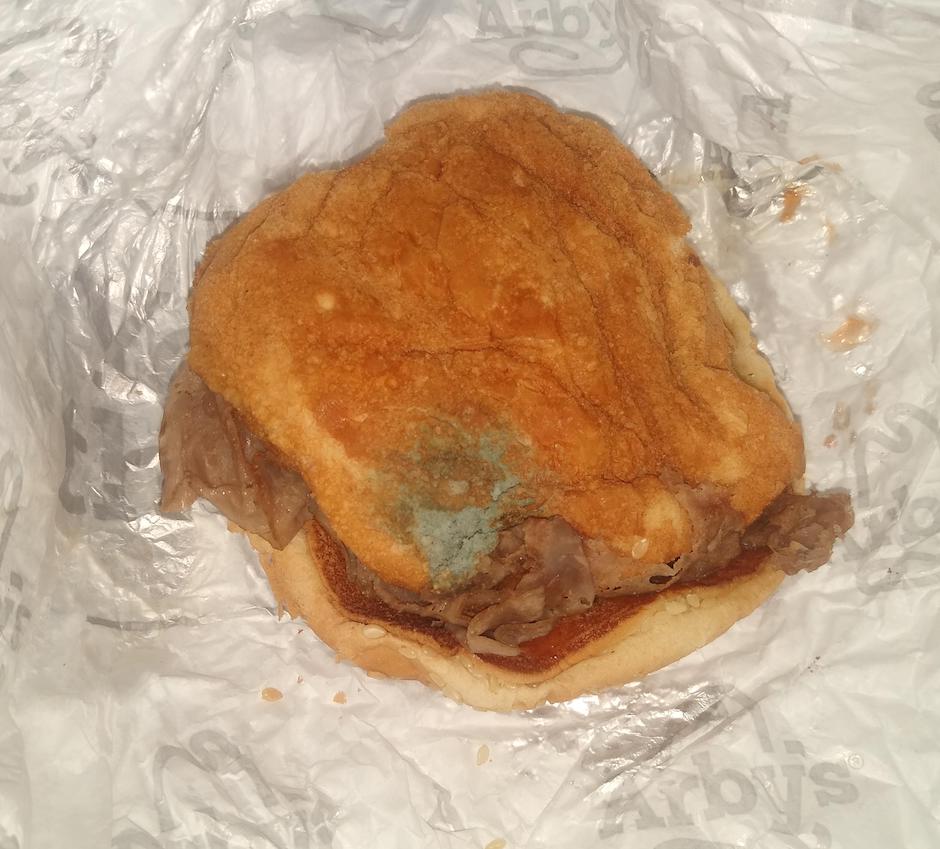

Grocery clerk Jimmy shows us what it means to slay, Kroger style.