Kroger fuel points are an integral part of the bulk gift card reselling market, perhaps more-so in 2022 than any other year. They’ve boosted that bulk market even further by running nearly non-stop 4x fuel points promotions on third party gift cards, including one that started on Wednesday and runs through Tuesday, September 20.

As we discussed in August though, something is rotten in the state of Denmark Kroger: The company is actively targeting suspected fuel points resellers and has seemingly shut down more accounts in the last couple of months than in the entire prior history of the program. It’s gotten so bad that I know of a single individual that had fuel points accounts worth over $10,000 frozen without recourse.

Without further ado, here’s a Q&A session that I held with my alter-ego to address questions that have been swirling around various groups and chat forums:

Q: What’s the trigger for an account that’s shutdown?

A: Datapoints are literally all over the place, and as of now we don’t really have a great idea.

Q: What does a shutdown look like?

A: At the pump when trying to redeem points, you see the message: “Invalid Loyalty ID”

Q: Can my fuel points account be unfrozen?

A: So far, I’ve not heard of a single success story or workaround

Q: How widespread is the shutdown risk?

A: It seems to be a minority of fuel points reseller accounts that are affected, but there’s a big “but”

Q: What’s the big “but”?

A: I’m so glad you asked. Even though it’s a minority of accounts that are shutdown, when a one of reseller’s accounts is shutdown, often so are a bunch of other accounts held by the same reseller

Q: How can I protect myself going forward?

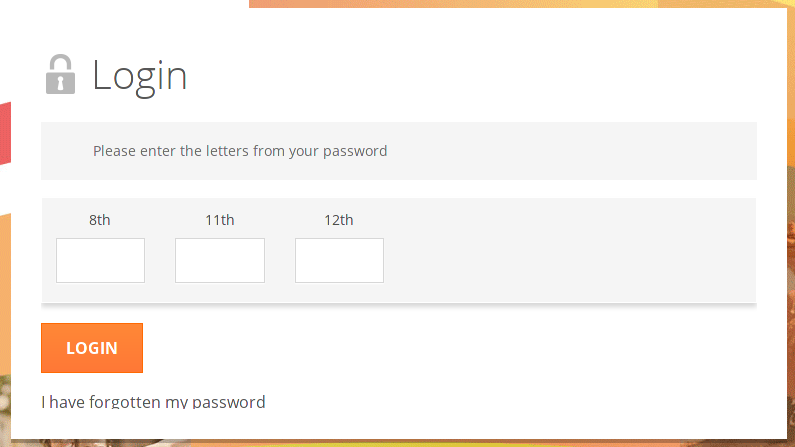

A: I’d say three things:

Q: Should I cut the fuel points game out?

A: I don’t think so, just be careful and follow my usual manufactured spend advice: never have more outstanding than you’re willing to lose if everything goes wrong

Have a nice weekend friends!

Just be careful, and you too can still be the Kroger fuel points GOAT.