Introduction

As we’ve discussed before in multiple instances, getting eyes an account ripe with shenanigans is a good path to a shutdown of at least that account, and probably all accounts held at an institution. So you should place a high priority on avoiding the prying eyes of an analyst when your account is filled with gift card purchases, payments by phone, money order deposits, anonymous payments, or anything else that banks don’t like in bulk.

Fraud Alerts

Perhaps the quickest path to an analyst from a bank’s fraud team looking at your account to do nothing when you get a fraud alert. That’s because when a fraud alert is generated, banks will put your account in a queue for manual review and (hopefully) notify you about the alert via a push-notification, text message, or email. Good banks will typically service that queue within 24 hours, while other banks like, I don’t know, Citi, can take up to a week to get through that queue. When an analyst pulls your account out of the queue, they may not like what they see and give you the axe.

If, however, you preemptively clear an alert, it’s almost always removed from the queue and no analyst looks at your account. Even better, fraud detection algorithms are usually trainable and a cleared alert means it’s less likely that you’ll see another alert in the future.

So when you get a fraud-alert, the action item is obvious: Don’t procrastinate. Just clear it as quickly as possible to keep anyone from looking at your account, either by responding to the alert or by calling the bank’s fraud line and hopefully doing it with an automated system. Bonus tip: if you can’t clear an alert with an automated system, calling outside of normal US working hours is more likely to get you to a customer service representative that lives in another country and is generally more apathetic about what happens in an account.

MEAB Scaremongering

So that we can appropriately calibrate urgency here: There’s buying a gift card or two and depositing a money order once a month, and then there’s going ham. If you’re not in that latter category I wouldn’t worry too much and just keep doing what you’ve always done. If not though, keep the bank’s analysts out of your accounts!

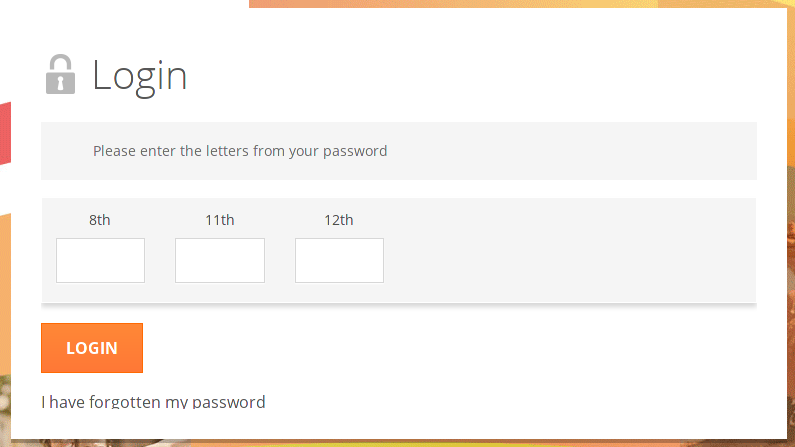

A captured screen shot from Citi’s soon to be released fraud alert verification system.