- Kroger has a 4x fuel points promotion on third party gift cards and fixed value Visa and Mastercard gift cards running through Tuesday, January 24. The market for fuel points remains strong, but as is typical, the market for gift cards to go along with those fuel points is relatively weak.

For gift card beginners: An easy way to dip your toes into the water is to buy a single $250 gift card (like Amazon or something else you’ll probably use). You’ll earn 1,000 fuel points worth $1 per gallon at Kroger and Shell gas stations, up to 35 gallons total.

For non-beginners: It’s go time. - Hyatt has a corporate status challenge for the third year in a row, and in theory this one allows for registration throughout the entirety of 2024; many large corporations are eligible, so if you’ve got a way to get an email address at a major corporation then you can probably register. The challenge:

– Earn Explorist for 90 days

– Keep Explorist through February 2026 with 10 nights

– Earn Globalist through February 2026 with 20 nights

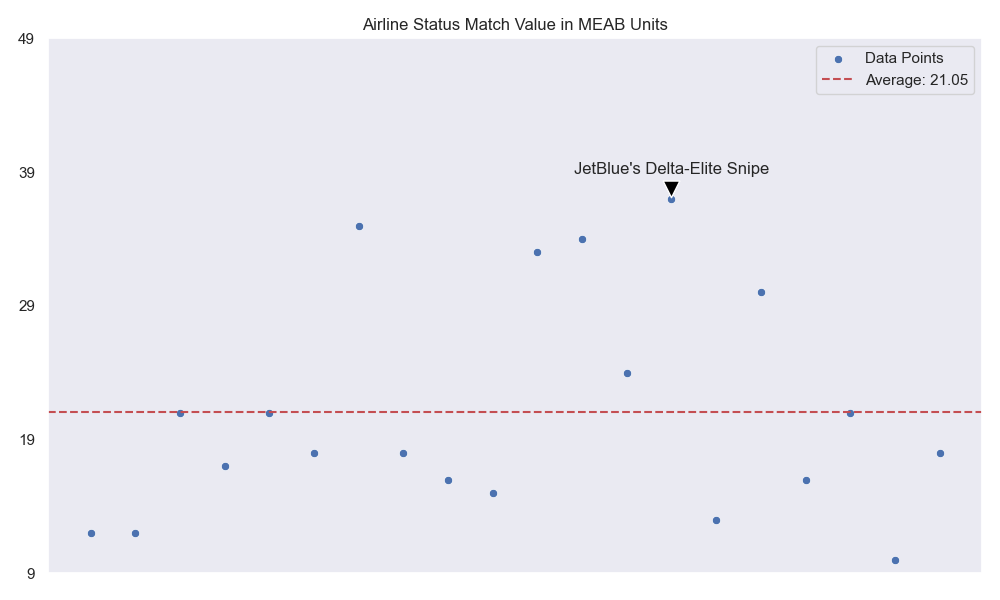

The now defunct, defacto way to manufacture this status was mobile check-ins at MGM’s Excalibur (or is it Exaliburist? I forget). After a status match, you’d effectively be buying elite nights at $20 each, and could complete a Globalist challenge for about $400. Now it’s a bit harder but there are always angles. (Thanks go Guilane2) - Apparently in an effort to rejuvenate spending on Delta cards after the October elite program massacre, American Express has new sign-up bonus level retention offers for existing card holders:

– Delta Platinum: 70,000 miles on $2,000 spend

– Delta Platinum: $1,200 on $4,000 spend

– Delta Reserve: 90,000 miles on $3,000 spend

To check retention offers, call or chat with AmEx and say something like: “I’m considering closing this card due to [reasons, like budgeting], but before I decide what to do, I’m wondering if there are any retention offers available?” If they give you an offer, always ask if there’s another offer available before accepting, often there is and it’s better than the first. (Thanks to royalic) - Stop & Shop, Martins, and Giant Food stores have 2x points on Vanilla Visa gift cards running through Thursday of next week. Note that Vanilla Visas have been rocky for the last couple of weeks, and you may find that some liquidation channels have a three swipe limit before the cards start declining for a while. (Thanks to GCG)

Have a nice weekend and watch for tomorrow’s guest post from SideShowBob233!

Unfortunately, we also no longer have access to Excalibur’s elite member welcome amenities.