EDITORS NOTE: In 2024, I’ve introduced Guest Post Saturdays. I’m still looking for more guest posts, please reach out if you have something interesting to share with the community! Today’s guest post is from Southwest Airlines kingpin and family travel guru, Brian M!

Garden The Flexible Options (GTFO) and travel better! Employing gardening strategies for multiple travel options reserved with flexible change and cancellation terms mitigates the risks of uncertainty and dampens the negative impacts of uncontrollable factors that affect travel. Moreover, one’s travel plans become more adaptable. For those about to travel, we salute you!

The concept of gardening a reservation is not new. In the travel maximization context, “Gardening” is the practice of booking and monitoring a travel reservation while consistently analyzing whether the booked reservation (which may have been impacted by some outside factor like a schedule change) may be efficiently improved through some sort of action(s) or change(s) and the activity of undertaking that action or change to improve the subject reservation. When factors affect a reservation that one is monitoring, then one may be able to (or may have to) undertake some action that could lead to an improved reservation. Always be probing the alternatives of a reservation to determine whether inaction, a change, or a cancellation may be the best decision. Deals can vary at original booking and over time; so, using and revisiting different levels of one’s travel waterfall of techniques is essential.

Flexible reservations are also not new; but, flexibility does have value. Most car rentals have long had very flexible cancellation terms. And, many hotel reservations have had flexible change and cancellation terms. More recently, flight reservations issued by more carriers, especially through their award loyalty programs, have become more flexible. Importantly, flexibility may be free! Okay, that’s not quite true because even if there is no monetary cost to a change or cancellation, one would still need to undertake the effort to book, change, or cancel a reservation (so, there is an expenditure of time and effort) and there’s an opportunity cost of those points or miles. Regardless, booking flexible rates/fares can preserve the ability to be ready for uncertainty, including both known unknowns and unknown unknowns. Fares and rates may drop. Flight times may change. New, more preferred, flights may become available. Accommodation amenities may close. Natural disasters may impact a destination. A car type may no longer be available or suitable. A travel companion may become ill or simply decide to no longer travel. To be impacted by an external force is human; to prepare for uncertainty is divine. Changes will happen and the adept can adapt by gardening existing flexible reservations. When the reservation gets tough, the tough garden the flexible reservation!

Options in travel, like in life, are important. Reserving multiple flexible options for aspects of travel or flexible options for entire trips enables one to gain more value and empowers one with more control to exercise the desired option (and cancel the undesired flexible option(s)) when it becomes time to strike. Furthermore, gardening those options amplifies the value and control unlocked by flexible change and cancellation terms. Could one sow one’s travel field with inexpensive option seeds with the intent that some schedule change or weather lemons may grow to produce a bushel of opportunities and enjoy some refreshing non-stop lemonade? However, to reserve multiple flexible options with award program currencies, one must earn those currencies first. Miles need to be earned before they can be burned. So, earning a sufficient volume of miles and points can be helpful to book early and book often. But, what volume may be sufficient varies and could be lower than may initially seem to be required given the ability to reduce, reuse, and recycle miles and points over time as options are canceled and changed. Miles burned for a reservation may rise like a phoenix from the ashes of cancellation ready to fly into action for the next reservation. Consideration about how to option the travel is also important – which traveler(s)? which flight(s)? which accommodation(s)? which date(s)/night(s)? which elite benefit(s)? which booking method? Considerations are unique for each aspect of each trip for each traveler.

And, putting these three concepts together creates a travel strategy greater than the sum of its parts empowering one to travel better. A trip that may have been originally booked with a 2-stop flight itinerary on a less preferred day to a counter pick up for an expensive compact rental car to drive to the Hyatt Place Lubbock may be gardened to become become a better option – a non-stop flight to stroll directly to the rental car aisle to choose any inexpensive full-size car to drive to the Hyatt Regency Wichita after freely canceling non-preferred flexible alternatives. However, time, effort, and organization are mandatory to the success of any GTFO travel strategy. So, determining how deep to dive into each aspect can be critical to maintaining sanity and avoiding The Optimizer’s Curse. Therefore, too many specifics related to a GTFO travel strategy would be imprudent. One must decide for oneself whether to, when to, and how much to utilize such a travel strategy. Of course, there are risks associated with the strategy beyond loss of sanity, including that duplicate reservations may be automatically canceled by the travel provider. Furthermore, speculation is undesirable: one must decide for oneself where to draw one’s own line – how far is too far and what may create too much risk given potential adverse consequences.

Travel is about the journey and the destination. So, utilize a GTFO travel strategy to burn some miles to GET THE F* OUT – both to travel better than one otherwise might and to spend less! Or, don’t travel – cash-out miles and improve life in a different way! No matter what, miles earned are only worth the value gained when burned.

“Better to be prepared for an opportunity and not have one, than to have an opportunity and not be prepared.” Travel opportunity is knocking and you may have the option to seize it today while maintaining the flexibility to seize a different opportunity tomorrow by gardening each of those seized opportunities until one becomes the best option.

– Brian M

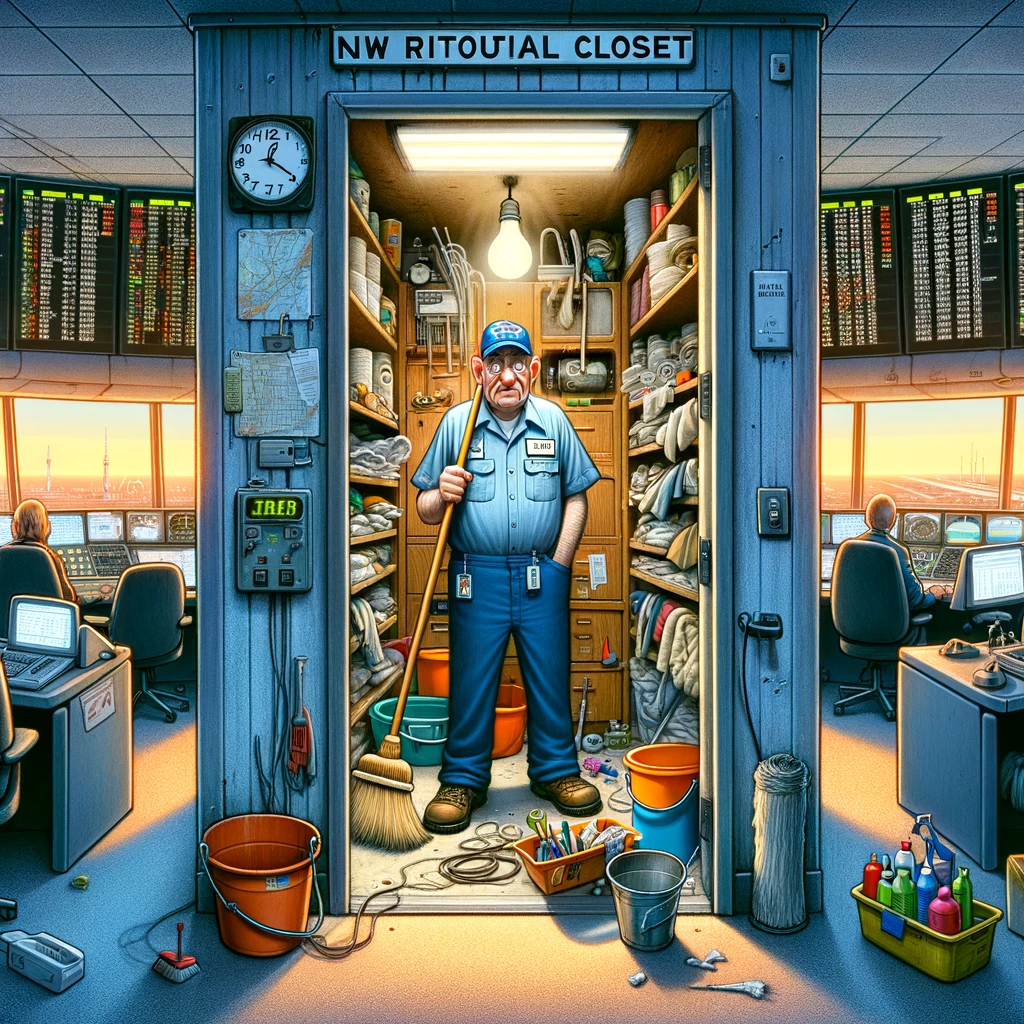

Preparing to garden a few existing bookings.