- Do this now: Register for Radisson’s spring promotion for 10,000 bonus points for every four nights stayed through May 31.

- Do this now: Register for IHG’s spring promotion for 2,000 bonus points for every two nights stayed in April or May.

- Wells Fargo launched the Autograph Journey card with a 60,000 point sign-up bonus after $4,000 spend in three months. Points are worth 1 cent each, and the $95 annual fee is not waived for the first year. The card also includes a $50 annual airfare statement credit.

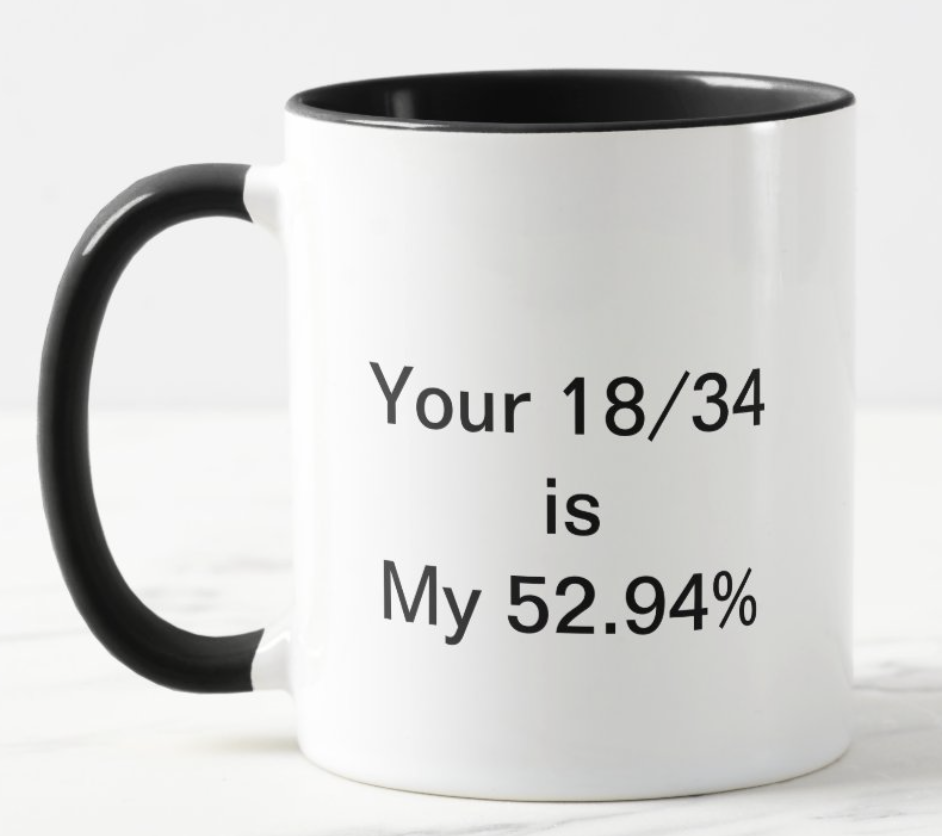

MEAB mini-review: Earning points on an ongoing basis isn’t easy without access to specific merchant coding, the hotel transfer partner is Choice which is already available with Capital One and Citi, and the airline transfer partners are widely available in other places too. It’s another bank to churn and therefore still interesting, and Wells Fargo is historically pretty abusable; but, you can do better with ongoing spend at other banks. On an arbitrary scale of 0-34, I’d give this a solid 18. - Stephen Pepper notes that Wyndham points can be purchased for 0.93 cents each through April 21. Wyndham only allows 100,000 base points purchased a year, but under this promotion you can net a total of 200,000.

These points typically resell at above 1 cent per point which, if nothing else, should tell you that the markets think this is a great deal and the only reason I’m writing about a points sale.

Have a nice Thursday!

The Wells Fargo Autograph Journey exclusive launch mug.