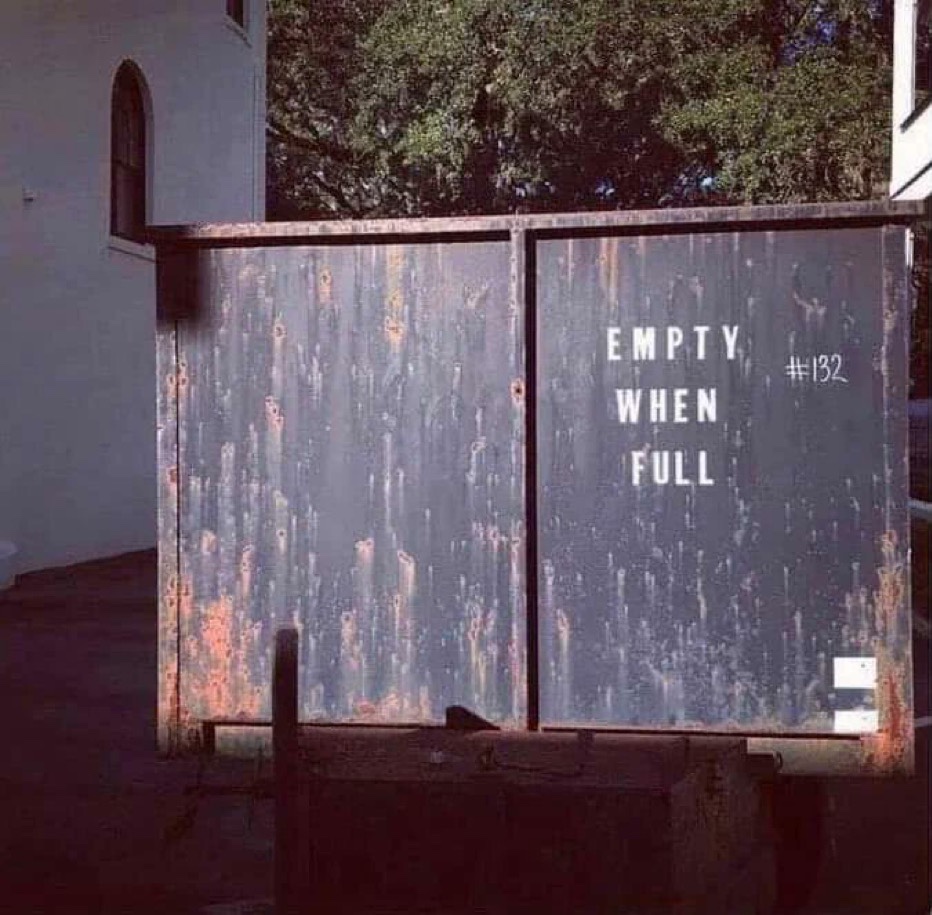

Three out of the four items for today are weird, but I’ll let you decide which.

- Meijer has a promotion for 10,000 MPerks points with a $100 Happy or Choice gift card purchase through Saturday, limit 10,000 points per account.

Convert these to BestBuy or Home Depot for the best return, and scale with multiple MPerks accounts. - Wyndham has a transfer bonus to United MileagePlus for a single transaction through the end of the month. Assuming you’re normally earning at 8x with the Wyndham Business Rewards card, the conversion gives you an effective earn rate of 3.2x MileagePlus miles per dollar which is actually great. The tiers:

– 6,000 Wyndham to 2,400 MileagePlus

– 16,000 Wyndham to 6,400 MileagePlus

– 30,000 Wyndham to 12,000 MileagePlus

– 60,000 Wyndham to 24,000 MileagePlus (May be targeted, thanks to pluckyhere)

Of course there’s a big asterisk here: you can only do this once and the promotion caps out at12,00024,000 MileagePlus miles. For the math challenged, that means$3,750$7,500 in spend at a gas station with the Wyndham Business Card. (Thanks to FM) - According to DoC, Capital One is sending targeted email offers for referring a new business to a Capital One credit card with a hefty $1,500 bonus up to three times for the referrer on top of the usual sign-up bonus for the referred.

I’ve yet to independently confirm this bonus in the wild, but it’s big enough that I decided to deviate from my norm and call attention to it anyway. (It’s “scruples be damned” Monday, right?) - Southwest has a sweepstakes for “learning about the benefits of Rapid Rewards Credit Cards”. It’s a memory match two card game, and you can enter once per day through the end of the month. The top prize is 25,000 Rapid Rewards points for the top of the leaderboard.

I wouldn’t normally write about this because most of you will end up with nothing, but now that we’re living in a new world order let’s talk gaming to sharpen your skills for the future: To win, train some AI on a throw away Rapid Rewards account then let it rip on your actual account daily. It’s the new normal and almost certainly what the winners are going to do unless the game is vulnerable to a JSON/XHR attack. (Thanks to Brian M)

Have a nice Monday friends!

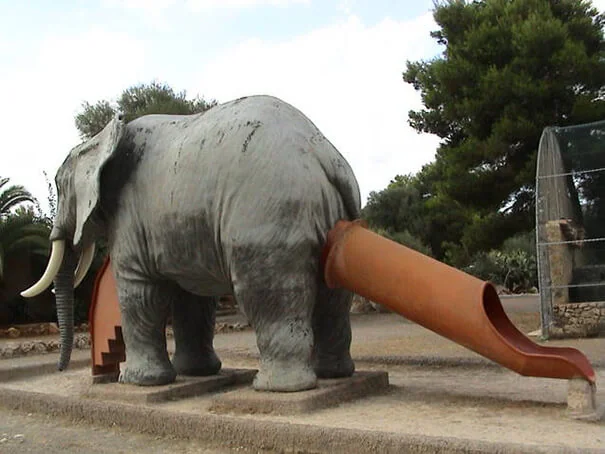

There are exactly three weird things in this picture too.