- Do this now: Register for Hilton’s Q1 promo for 1,000 bonus points per stay and double points on all spend associated with a folio including room fees for stays through April 30, 2023.

- Staples has a fee free $200 Visa gift card promotion running Sunday through the following Saturday, limit eight per transaction. These are Metabanks so have a liquidation plan before you load up; there are plays out there, both online and in person.

- Apparently Turkish Airline’s promotion for 30% off of economy and business class awards for travel through May 2023 excluding U.S. Cities isn’t actually excluding U.S. Cities because programming is hard, so book quickly if you have any United or other Star Alliance travel planned before it’s fixed. UPDATE: DDG provides an example of SEA-FCO pricing at 30% off, but CitizenKane notes via MEAB slack that there’s a separate promo for SEA and maybe there’s no actual bug here. (Thanks to DDG)

- Reader Mark wrote in to let me know that Bitmo, which is continuing it’s slow death spiral via rocket launch into the ocean, is issuing gift cards for redeemed points if you email support and wait for a few weeks for them to come through. I’d still stay away from their new company HungryFriend (in this instance I think they’re the hungry friend).

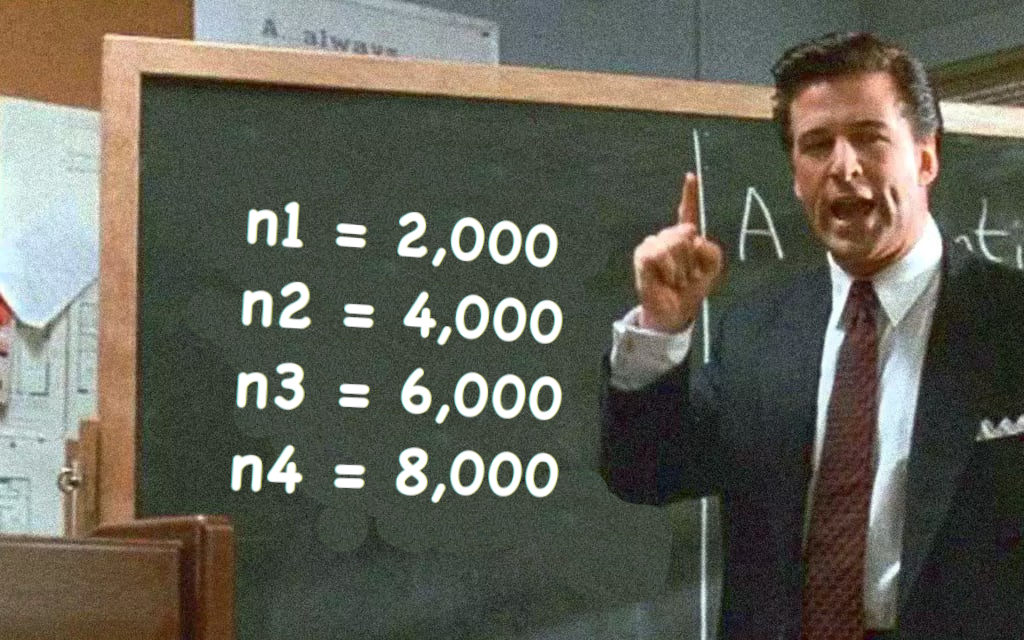

- American Express has a 30% transfer bonus from Membership Rewards to Virgin Atlantic miles through December 29. Award sweet spots:

– Business class on Delta to Europe

– Business class and first class to Japan on ANAUnfortunately there’s no current transfer bonus to Virgin Galactic, but if there were maybe Bitmo would have had a better shot.

Have a nice weekend!

The rocket Bitmo used to launch its company to the moon; spoiler alert, it missed.