- Do this now: Register for your personalized United MilePlay offer. I got 7,400 bonus redeemable miles with a $650+ premium fare flight booked and flown by June 7.

- The Citi AA Business card has an elevated 75,000 mile sign-up bonus after $5,000 spend

a single purchase, and the $99 annual fee is waived the first year. Note: I tried to strip off any tracking parameters from the offer, but it wouldn’t load when they’re stripped off. As usual, I’m not here to sell you credit cards and I won’t earn anything if you use this link.

If you thread the needle through the terms and conditions and the sign-up bonus sticks around long enough, you can get it twice in just over three months, keeping in mind that business card approvals at Citi require 91 days between applications. - Office Depot / OfficeMax stores have $15 off of $300 or more in Visa gift cards through Saturday. For best bang:

– Even multiples of $300 typically offer bigger per card discounts

– Try for multiple transactions back to back

– Link your cards to Dosh

– Don’t forget the American Express Business Gold $20 monthly credit

– Look for lower fee Visas (currently, new cards are rolling out with a $7.95 activation fee)

These are Pathward gift cards, so have a liquidation plan in place. - You can make six credit card payments with your tax return or extension due today, which is a low friction way for manufactured spend provided you can float the money in case of any potential IRS holds. You get two payments each with PayUSATax [1.82%], Pay1040 [1.87%], and ACI Payments [1.98%]. The same game works with quarterly estimated taxes to scale this throughout the year.

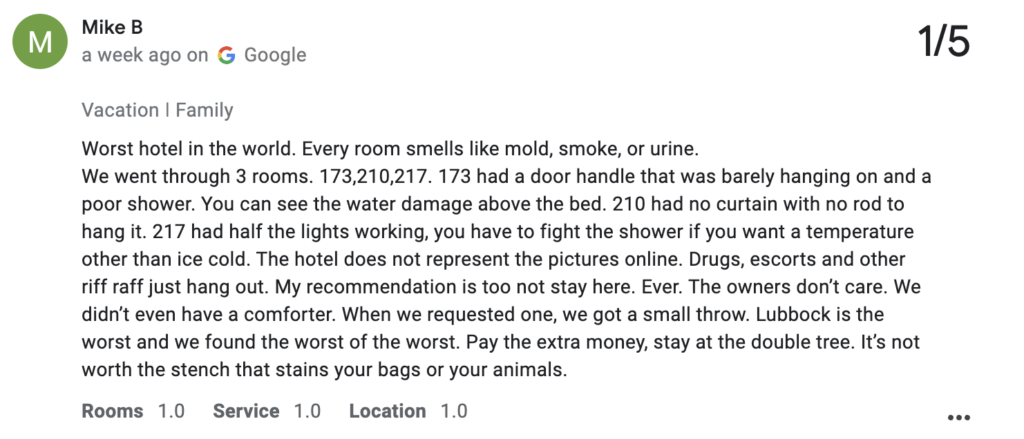

Usual disclaimer: I’m not a tax professional or an accountant, and you shouldn’t listen to my advice about anything, ever. - Southwest has a promotion for 25% off base fares with promo code SAVE25NOW booked by this evening. There are blackout dates, and not all flights on non-blackout dates are included, but isn’t that what Wanna Get Away+ fares are for?

MEAB vibes.