I guess it’s patriotic to tie the number four into a post on the 4th? To be honest I wasn’t really listening during my Patriotic Blogging 101 course in college, so let’s just assume that I’m right and roll with it. I know I will.

- Visible has $45 in cash back (or 4,500 Membership Rewards) at Rakuten for the fourth of July holiday and it stacks nicely with a few other offers. We’ve seen better around black Friday, but if you need a burner phone number for shenanigans, this is a great deal for this time of year. You’ll get:

– $50 Mastercard from Visible for porting in a number (like a $0.99 Boost number)

– $45 cash back or 4,500 Membership Rewards via RakutenAnd your cost will be:

– $5 with a referral (with a current Chase or Bank of America offer for $20 off of $25) for the first month

– $20 with Party Pay for the second monthOf course, you can use the same tricks to upgrade an old or very old phone to a new Moto G Pure android for negative cost.

- There are targeted Chase offers for:

– 15% back at United for airfare

– 15% back at IHG and several Marriott brandsThe total cash back varies by account and can be as low as $10, or as high as $40.

- Check for a targeted spend offer from Barclays personal cards via email for 5x rewards at grocery, drugstores, and restaurants up to $700 in spend. (Thanks to DoC)

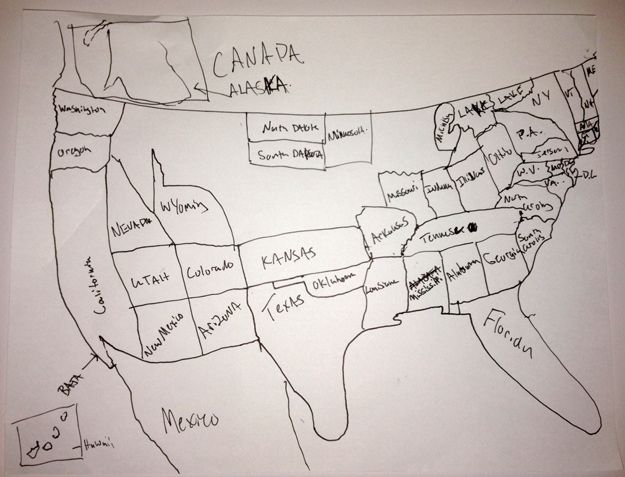

- Meijer has two Visa gift card deals, and one works even if you’re outside of Meijer land. Just be sure to scale with multiple MPerks accounts and use them all back-to-back as quickly as possible, like La Jolla, San Diego in 2012:

– $5 off of $100 in Visa gift cards online, these are Metabank cards

– $10 off of $150 in Visa gift cards in-store, these are either Sunrise or Metabank depending on which you pick (I’d definitely pick the former)(Thanks to Stephan at GC Galore)

Have a nice holiday!

Blowing up a Meijer terminal La Jolla style with hundreds of MPerks accounts. Go big or go home, amirite?