Hopefully you’re recovering from any Friday afternoon RobinHood induced hangovers that may have found their way into your accounts (more to come later). To help, focus on the following:

- American Express has an offer for $200 back on $1,000 in spend or more with AirFrance/KLM. This one is an easy base-hit with correlation breaking, no phone calls needed; as usual you could instead just be basic and actually book airfare and fly as intended. (Thanks to hwplainview41)

- Giftcards.com has another promotion code for 5% off the total purchase price of Visa e-gift cards: YAYSUMMER.

I’m still seeing 4% back on the Capital One Shopping mobile app and purchases are tracking each time for me. Limits are $2,000 per rolling 48 hours, and $600 per order, both per email address. Don’t log in for the promo code to apply. - On Friday we discussed an increased sign-up bonus for a few Barclays cards, and on Saturday a link surfaced for an even better version of the Hawaiian card sign-up bonus: 70,000 miles with only a single purchase of any size. (Thanks to DoC)

- The Delta SkyMiles portal has a rare spend bonus: 500 miles on purchases summing to $100 or more through June 9.

- Office Depot / OfficeMax stores have a gift card promotion for $15 or $10 off of $300 or more in Mastercard gift cards. Watch out: normally this is a negative cost deal with $15 back, but in some regions it may be $10; with the reduced payout and $6.95 purchase fees you’re looking at $403.90 for $400 in gift cards (or $303.90 for $300 in gift cards if you hate maximizing things).

These are Pathward gift cards so make sure you can liquidate before you buy a bunch. There are still methods out there that work, always be probing. - Meijer stores have $25 worth of points back on $250 or more in third party gift cards other than Amazon. Scale with multiple MPerks accounts. (Thanks to GCG)

Happy Monday!

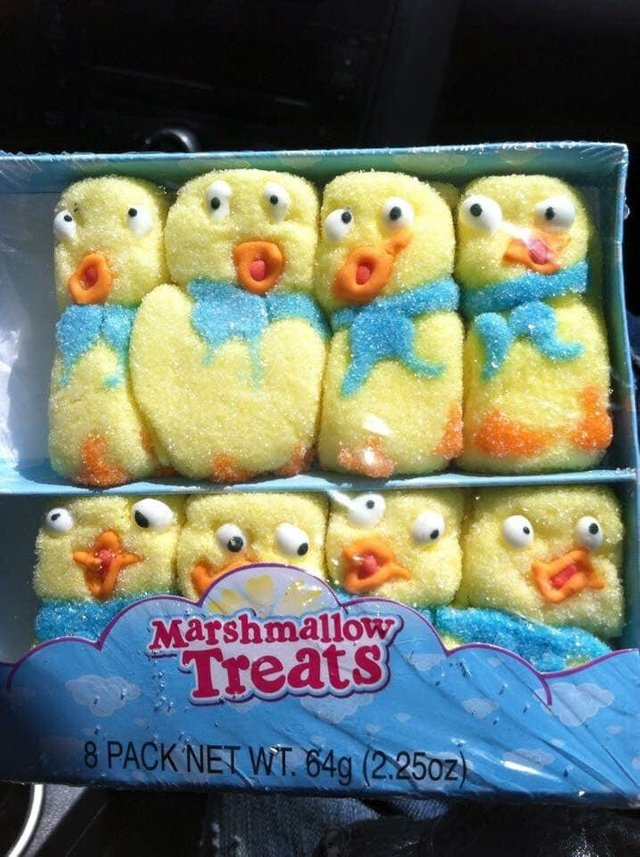

The source of Friday afternoon’s sadness.