- Giftcards.com continues to award 5% off of virtual Visa gift cards with the promo code CYBERSAVE. It’s supposed to end today but often these keep going well beyond their stated expiration (and just as often they expire well before their stated expiration, because reasons). Make sure you bounce through a shopping portal first, and you may be luckier than you realize if your order is canceled.

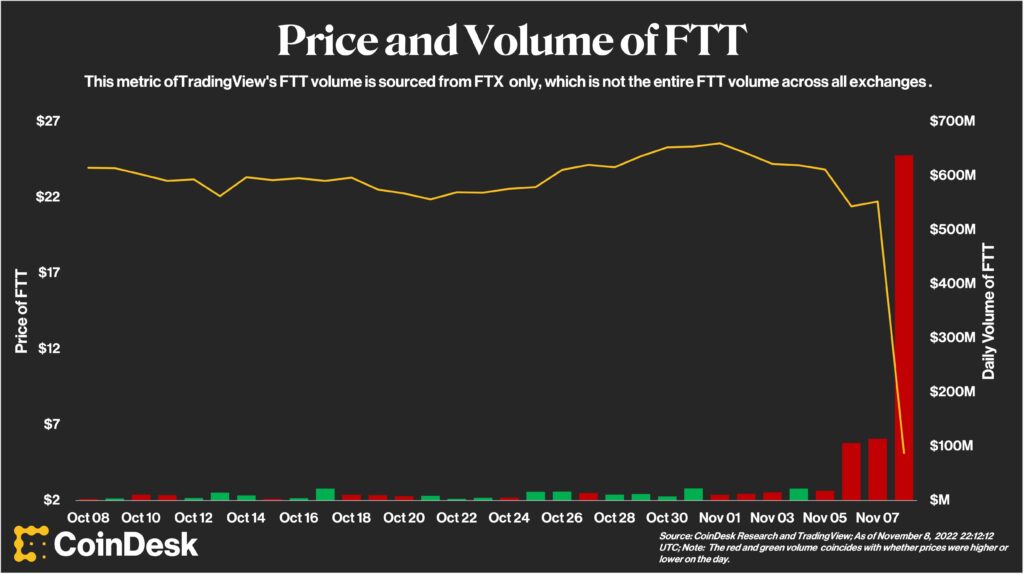

- The Aegean Airlines free miles game has been kicking around since Friday, but it’s become quite a bit more interesting in the last 24 hours: many new accounts are seeing high mileage awards in the 20,000 miles or above range. Why is this useful? Two reasons:

– 25,000 miles is enough for a roundtrip economy flight on United Airlines or Air Canada between any two North American cities

– 90,000 miles is enough for a roundtrip business class flight on United Airlines or Air Canada between North America and Europe - Reader H wrote in to let me know that American Express gift cards are fee-free using promo code HOLIDAY2022 (including gift cards well into the 5 figure range). There are two uses for this that I see:

– Shift minimum spend

– In conjunction with AmEx offers at amexgiftcards.com - A new Kroger 4x fuel points promotion starts today (in theory), and presumably includes online gift card purchases too. They’re also selling several travel gift cards at a net discount, and you’ll earn at least 2x and possibly 4x fuel rewards on these purchases:

– Uber: Buy a $200 gift card and get a bonus $25 Kroger gift card

– Delta: Buy a $100 gift card and get a bonus $10 Kroger gift card

– Airbnb: Buy a $200 gift card and get a bonus $25 Kroger gift cardIf you buy all three of these and use approximately 15 gallons when you fill your car, the fuel points are worth about $30. (Thanks to GC Galore)

- According to Doctor of Credit, Office Depot/OfficeMax stores have a promotion for $15 off of $300 or more in Mastercard gift cards. If this promotion is like other recent variants you may even be able to do better than $15.

A manufactured spender readies for the holiday grind on a United flight to Lubbock, TX booked with Aegean miles.