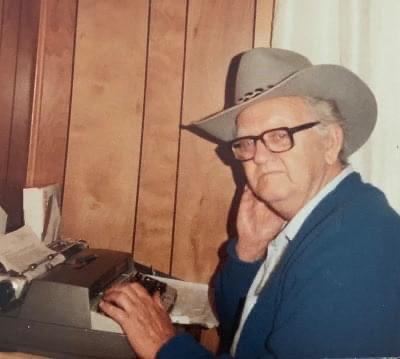

Today, MEAB features a special guest who will respond to each news item: Your annoying Uncle Kyle that always seems to have a take that’s tangential to reality but not grounded in reality. Why? Practice my friends, practice – because you probably only see Kyle at Thanksgiving and Christmas and it’s time to gear up.

- Southwest flights are now bookable through the Chase travel portal, but only Wanna Get Away and Wanna Get Away Plus fares.

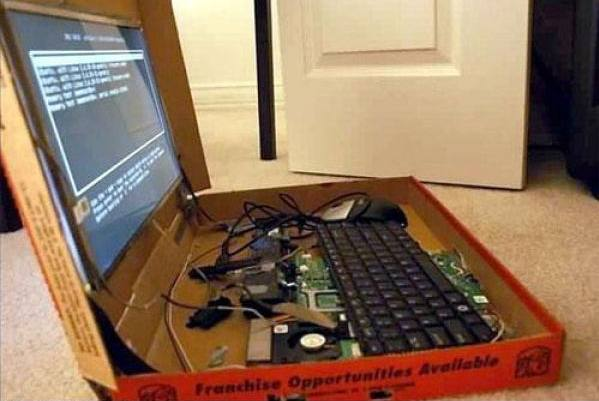

Kyle’s response: WGA+ fares as a 1.5 cent per point booking with low friction means that brokering of Southwest flights is going to skyrocket. Watch out! - Office Depot/OfficeMax stores have $15 off of $300 in Mastercard gift cards through Saturday, limit eight per transaction. As usual, link your cards to Dosh, liquidate your American Express Business Gold $20 monthly credits, try for multiple transactions back-to-back, and experiment with different purchase amounts.

Kyle’s response: You’re waiting in line behind someone arguing about a $0.45 coupon at a store with staffing levels lower than the half-sized aisles of InkJet toner to buy a Mastercard with a Visa? Are you even listening to yourself talk? - Chase Offers has 13% back on at least $50 and up to $307.69 in airfare booked by tomorrow. (No, I didn’t make that number up, why do you ask?) This is gamable in multiple ways.

Kyle’s response: I haven’t known anything about gaming since Tetris, but you know that booking airfare means flying Southwest right? Their boarding process is a mass psychological experiment and you’re the subject! - UPDATE: Dead! There have now been at least a half dozen reports of successfully transferring the pseudo Ultimate Rewards with a fixed 1.0 cent per point from the Ink Business Premier to real Ultimate Rewards accounts from other premium cards, but only by phone.

It’s unclear if this is a bug or intentional, but either way the 150,000 pseudo Ultimate Reward sign up bonus for $10,000 spend in three months available in branch or perhaps via Green Star offers looks extremely attractive right about now, especially if you can earn it quickly.

Kyle’s response: You know that those pseudo Ultimate Rewards points are how the government tracks your spend, right? Converting them to a variable value point throws them off because they can’t know exactly what you spent.

Have a nice Monday!

Kyle’s response: You do know Mondays suck, right? Everyone knows that because Garfield taught us. Stop being so chipper.

Even the Thanksgiving pie will be fed up with Kyle.