- Staples is having a fee free sale on $200 Visa gift cards running Sunday through the following Saturday, limit eight per transaction. Don’t forget that the Mastercard version of this sale runs through tomorrow so you get exactly zero days off.

These areMetabankPathward gift cards, so have a liquidation plan in place. - Simon’s online volume site has 100% off of shipping and processing fees on $4,000 or more in cards per order through May 1 with promo code MAY23FLASH100. You’ll still pay purchase fees of $3.95 per card.

Most of these areMetabankPathward gift cards, so have a liquidation plan in place. - Delta has a rare shopping portal bonus for 500 bonus miles after $100 or more in cumulative spend through May 5. Dell or Saks are often good options in the absence of giftcards.com on airline shopping portals.

- A reminder: Kroger has a one day 4x fuel points promotion on third party gift cards running today only.

A note: These one day sales seem to confuse Kroger IT, and there are indications that they continue to be confused. Always be probing.

Have a nice weekend!

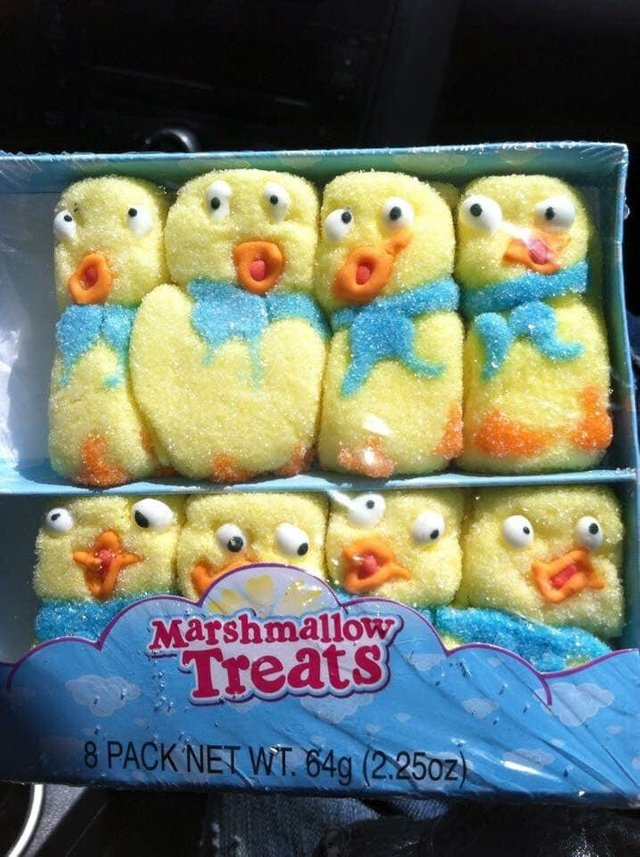

A sample of what you might discover at Kroger.