- The Chase United Business MileagePlus card has a heightened sign-up bonus of 100,000 MileagePlus miles after $5,000 spend in three months. The $99 annual-fee isn’t waived, and neither is the surly service that you’ll get onboard either.

This probably isn’t the best option to hold on to after year one, but I do like holding at least one United card at a for expanded award availability (XN acccess). - The Chase United Club Business card also has a heightened sign-up bonus of 75,000 MileagePlus Miles and 1,000 Premier Qualifying Points after $5,000 spend in three months. The $450 annual-fee isn’t waived, and the card also gets you access to unlimited crackers, cheese cubes, and Coors Light when visiting a United Club.

I’d hold this card if I were regularly flying United out of an airport with a United Club for XN access and club access, but fortunately for all of us I’m not currently doing that; if I was you’d have suffer through me whining about United a lot more than you already do. - Kroger.com has $10 off of $150 or more in physical Visa and Mastercard gift cards through January 31 with promo code NEWYEAR2024. A few notes:

– The activation fee recently increased to $6.95 on the $100 cards

– You’ll be earning 2x fuel points

– You won’t earn a grocery category bonus

– These are US Bank cards

You’ll pay shipping too, but the cheapest option is ~ $0.50. - Staples has fee free $200 Mastercard gift cards starting Sunday and running through the following Saturday, limit eight per transaction.

These are Pathward gift cards, so have a liquidation plan in place, in-store limits are $480 every six minutes, unless you get lucky and your store cycles through merchant accounts. - The Chase Marriott Boundless Visa card has a heightened sign-up bonus for five free night certificates for up to 50,000 points per night after $5,000 in spend in three months, and the $99 annual fee is not waived for the first year. The certificates expire one year after issue.

Given Bonvoy’s hyper-inflated currency, 50,000 points may not get you a night at your favorite hotel, so double check that you won’t need to burn these in Lubbock because everything else is priced out of your range. No really, the Courtyard Lubbock is 39,000 points. - Giant Food and Martin’s stores are running a 10x points promotion on Apple gift cards through February 1, limit $2,000 in spend per account. (Thanks to GCG)

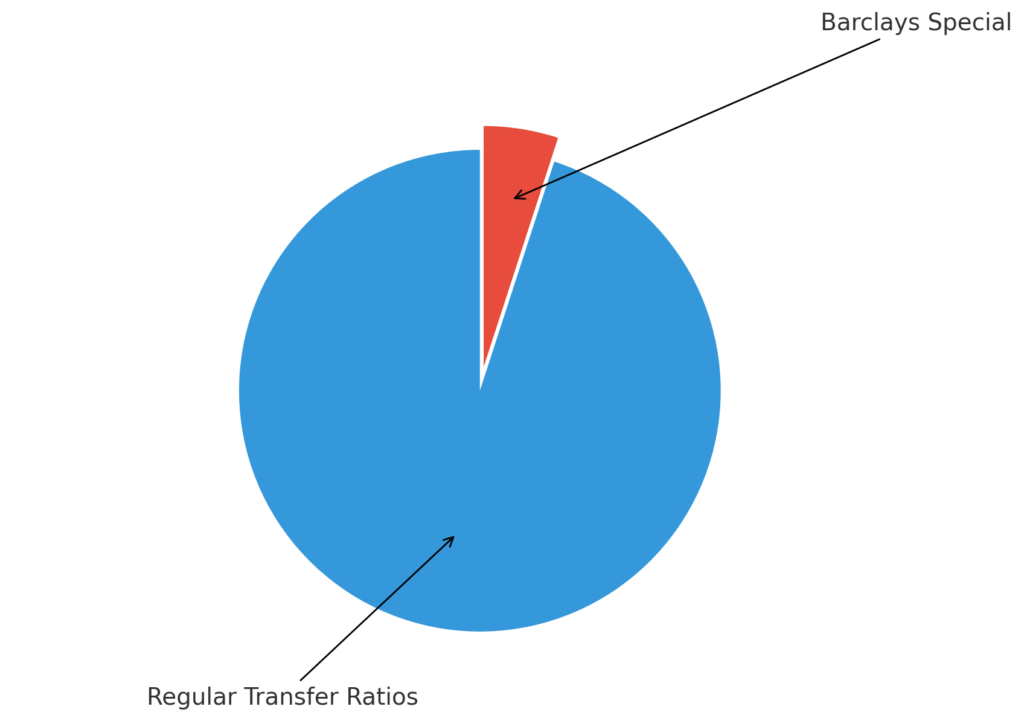

- Some American Express accounts have a targeted upgrade from a Business Gold to a Business Platinum with 120,000 Membership Rewards after $10,000 spend in three months. To see if you’re targeted, look for a popup on the dashboard. (Thanks to joremero)

With hip styling like this, who wouldn’t want to burn 39,000 Bonvoy points at the Courtyard Lubbock?