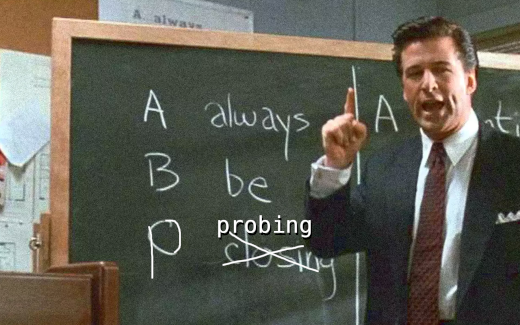

If you were a programmer at a bank and you had to code a bonus category for a particular vendor, say like earning 32x Membership Rewards points on flights to Mars booked through Deep Discount Mars Trips, how would you do it? You’ve got a few decent options for how you might award a bonus based on:

- A particular merchant account and payment processor

- A particular merchant category code (MCC)

- A specific merchant name, like “DEEP DISCOUNT MARS TRIPS LLC”

Of course you don’t have to pick just one of those, good banks and good programmers will do two or all three. Of course, there are some FinTechs out there that take the easy way out and do the bare minimum, for example, searching for “MARS” in a charge’s name and awarding 32x if the letters are found in the charge description. When that happens you’ll earn 32x at:

- Marsha’s Grab and Go

- Cactus and Marshes LLC

- The Marshmallow and Vacuum Emporium

Often the FinTech programmer figures out that they’ve made a mistake and will fix the bonus award by implementing a blocklist instead of fixing it the right way, so the logic is: Award 32x if “mars” is in the charge description, but not if the description is “The Marshmallow and Vacuum Emporium”. Because of course they do.

Well, in the cat-and-mouse game with FinTechs, there are often ways to name-mangle your merchant description to side-skirt blocklists, for example by paying with a service like PayPal which will prepend PAYPAL MARK* to the front of your charge description, leading to 32x again.

It should probably go without saying, but let’s say it anyway: bonus street cred if you use one FinTech product to mask the charge for another FinTech. Happy hunting!

The Marshmallow and Vacuum Emporium, ripe for earning 32x.