It’s been a whopper of a week for deals, and today continues the trend:

- Mason was the first to let me know that American Express Business Platinum 99 employee card offers are back and seem to be widely targeted (they appeared on my Business Platinums too). The vitals:

– 20,000 bonus points per employee card after $4,000 in spend in six months (effectively 6x)

– Limit of 99 employee cards, for a total of 1,980,000 Membership Rewards

– Must hold card open for 12 monthsThe six month timeframe is better than the prior offers on the Business Platinum, though the spend isn’t as generous as we saw for a brief period on the Blue Business Plus card. Right, junior? Or should I call you senior?

This is the second American Express offer that’s risen from the dead this week. If you’ve squirreled away any pay-over-time offers, authorized user card offers, upgrade offers, or anything else really, you might find that it’s worth your time to try those links again.

- There’s a new way to cash out your various Clear credits: Sign up for Clear and get a $75 Uber credit. This offer has language suggesting you actually need to complete enrollment at the airport, but let’s just say I doubt that’s true.

Personally I’d rather take advantage of the United 15,000 miles version of the offer with any remaining Clear credits, but sadly that offer expired. (Thanks to jcarberry)

- Do this now: Register for 5,000 bonus points per stay at Raddison hotels for stays through June 30.

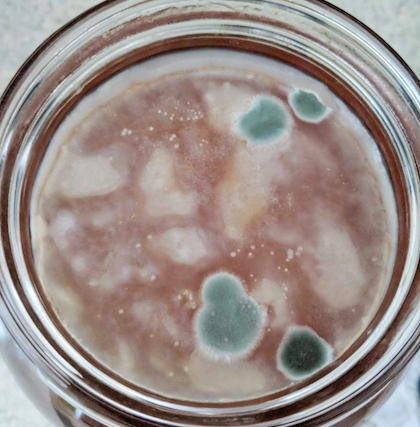

Pictured: Junior and senior meeting minimum spend on employee cards.