We tend to focus quite a lot on Chase, Bank of America, American Express, Citi, and Capital One because they offer good products for manufactured spenders and churners, and because their products are available to most any US Citizen.

That said, there are more than 4,500 banks and more than 4,700 credit unions in the US, and we spend nearly all our time talking about fewer than 10 of them in total partially because 97% of these institutions primarily serve only small geographies. It’s a mistake to ignore other banks and credit unions though, because they have financial products too, and some of them are just as generous as those you’ll find at the big usual suspects.

To up your game, consider spending time strolling around your local banks and credit unions (they’re usually one district over from the hammock district), and look into their:

- Credit cards with rewards or cash back

- CDs that may be funded in various ways

- Bank accounts that may offer a sign-up bonus, rewards, or a money order target

- Loans that you can find in various payment systems

- Teen spending products

- Business banking offerings

As far as I’m concerned, who cares if Holy Trinity Baptist CU shuts me down when I’m trying something with MoneyGram and their credit card that I’d never dare try with a Chase card?

Have a nice weekend!

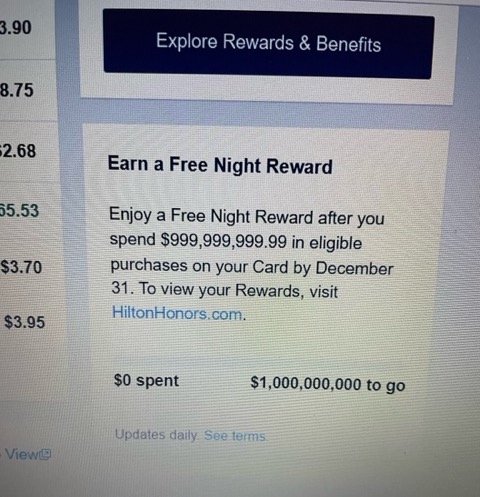

Even Lubbock Telco FCU has better offers than AmEx at times (Thanks to Reader Ben for the photo)