- At least three Chase cards will have increased bonuses and possibly be retooled on Monday, with the retooled versions likely becoming available by referral around a week later.

– Sapphire Preferred: 100,000 Ultimate Rewards after $5,000 spend in three months

– United Explorer: 80,000 MileagePlus after $3,000 spend in three months, increased $150 annual fee

– United Business: 150,000 MileagePlus miles, increased $150 annual fee, increased coupon-book credits

Will the $95 Sapphire Preferred annual fee remain? It feels unlikely. Will the no annual fee ink card see an increased bonus of 90,000 Ultimate Rewards? It feels possible. What makes me say that? Chase’s tooling tends to work in groups. Do I understand that it’s annoying when someone writes repeated questions and then answers them? Yes. #sorrynotsorry - The FBNO Amtrak Preferred Mastercard card has an increased sign-up bonus of 40,000 points after $2,000 spend in three months.

These points are worth 2-3 cents each for travel on Amtrak. If you’re lucky maybe they’ll combine a hard pull for this card with a hard pull for a JAL card, useful especially because FBNO doesn’t mind a lot of spend on its cards. (Thanks to kingmaine) - The Target RedCard flavors each have a sign-up bonus of $50 off of $50+ coupon at Target within the first 30 days. These cards are churnable, and if you don’t like talking to people you’ve got to wait about eight weeks in-between closing and reopening for auto-approval.

There’s no credit pull for the debit or reloadable flavors of the card. - Wyndham launched a new rewards debit card a few days ago that earns 0.5 points per dollar on general transactions, has a $6 monthly fee, a 2,500 point sign-up bonus with hurdles that make it not worth worrying about, and 7,500 bonus points annually. Wyndham points are worth more than Hilton or Marriott, but they’re still not usually worth much more than a penny each. I initially didn’t write about the card because this site’s goal isn’t to be an anthology of everything that happens in churning (there are other sites for that), and so I didn’t think it was worth my time or yours.

But a few days of percolating have changed my opinion. The card is issued by Sunrise bank which is usually happy to give anyone an account, and it has a different BIN than other debit card BINs that have been blocked at some banks, credit unions, and bill pay services. I’ll be getting one to toy around with, but just because I’m doing something doesn’t mean you should do it too.

Happy Thursday!

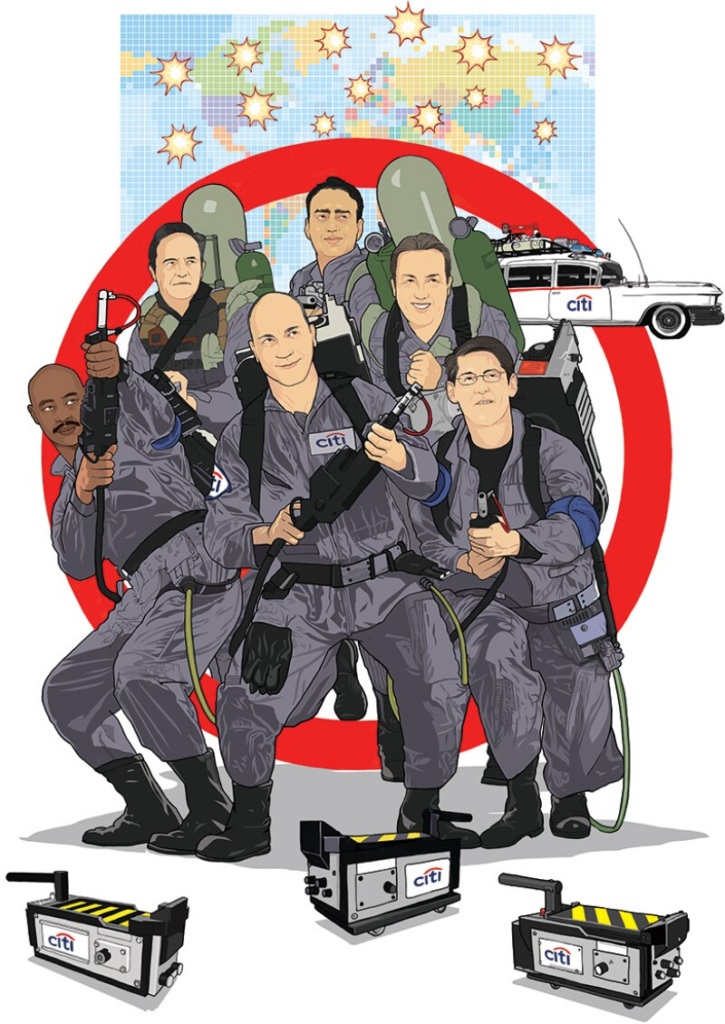

Chase’s credit card bonus retooling machine.