Warning: Lots of words today, sorry.

- Do this now: Register for 2,000 bonus points per two night or longer paid stays at Marriott properties through November 26.

- The American Express Delta cards have increased sign-up bonuses:

– Gold: 80,000 SkyMiles after $3,000 spend in six months, annual fee waived

– Platinum: 90,000 SkyMiles after $4,000 spend in six months

– Reserve: 100,000 SkyMiles after $6,000 spend in six month

– Gold Business: 90,000 SkyMiles after $6,000 spend in six months, annual fee waived

– Platinum Business: 100,000 SkyMiles after $8,000 spend in six months

– Platinum Reserve: 110,000 SkyMiles after $12,000 spend in six months

There’s also a targeted offer for the personal Gold at 50,000 SkyMiles + $500 after $3,000 spend and a single Delta purchase in six months during a flight booking, so consider that too. Also, note that all three versions of the business cards still have offers for adding employee cards and spending, up to 99 times. - The American Express Marriott Business card has a heightened sign up bonus for five 50,000 free night certificates after $8,000 spend in six months. The certificates expire after one year, and can be topped off with points for up to 15,000 additional points per night. I expect this offer will be available via referrals shortly, so maybe wait for a couple of days and get it via referral. This card also has offers for adding employee cards and spending, up to 99 times.

When evaluating the value of this card, please check the points cost of properties you might be interested in staying at; 50,000 points isn’t exactly top-tier in the Marriott program. Also, remember you’ll still be paying for resort fees and parking when staying on your free night certificates. - The Chase IHG cards have increased sign-up bonuses:

– Personal IHG Premier: Five free night certificates (60,000 points each) after $4,000 spend in three months

– Business IHG Premier: 200,000 points after $9,000 in tiered spend in three and six months

Both of these are likely more valuable than their Marriott counterparts if IHG’s hotel footprint follows your travel patterns. Both will likely be available via referrals in a few days too – so practice patience again. - Giant, Giant Foods, and Martins stores have 2x fuel points on Vanilla Visa gift card purchases through Thursday, limit $1,500 per account.

- Stop & Shop, which is part of the same conglomerate as Giant, Giant Foods, and Martins, has a 3x fuel points promotion on Vanilla Visa gift card purchases through Thursday with no limit currently specified. But, historically “no limit specified” doesn’t mean no limit at these stores, so mind the gap I guess.

- Staples has fee free $200 Visa gift cards starting Sunday and running through the following Saturday, limit nine per transaction.

These are Pathward gift cards.

Have a nice weekend!

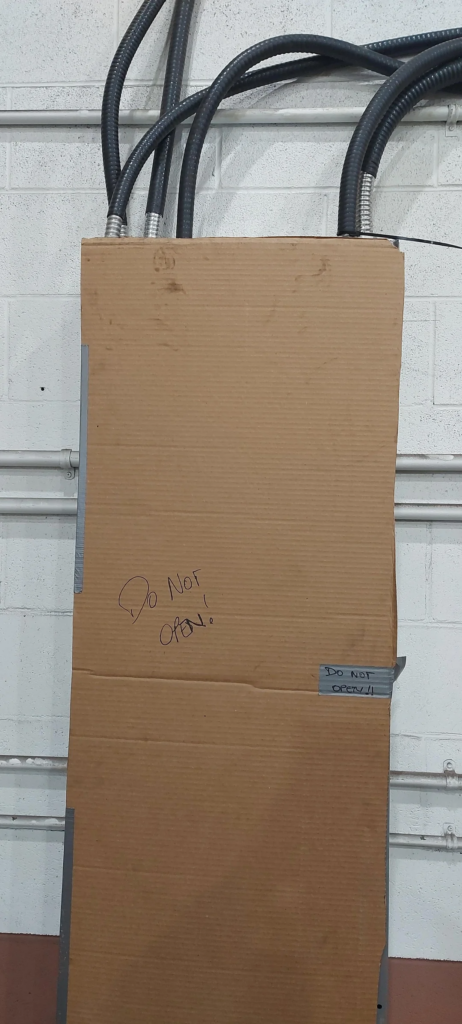

Note: Adding 99 employee cards to your new accounts does have side effects.

(Thanks to Malia for this unfortunately very real image)