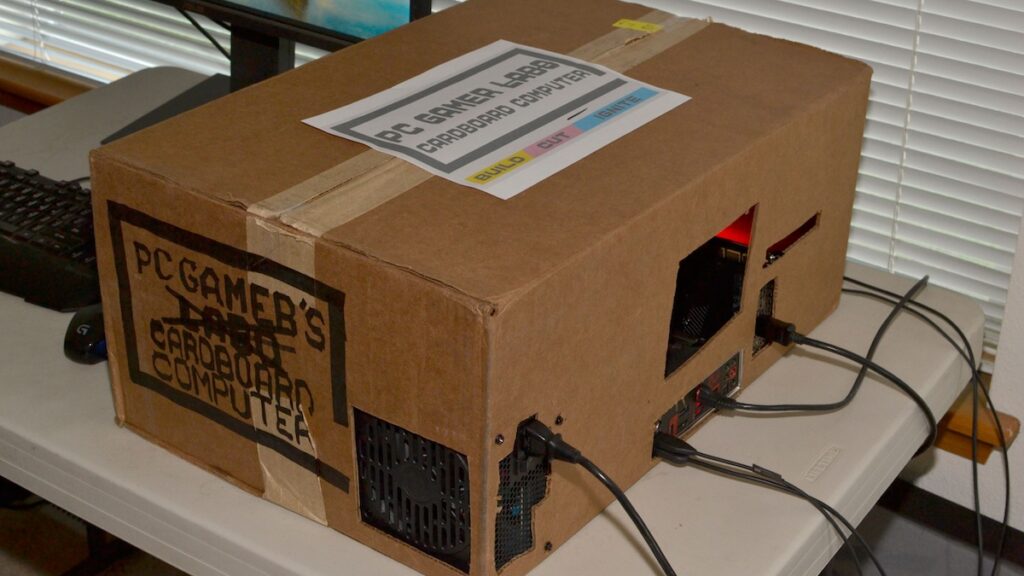

- The American Express Business Platinum’s Dell and Adobe credits are changing starting on July 1:

– The Dell credit will be $150 annually, plus another $1,000 after $5,000 in spend at Dell

– The Adobe credit will be $250 off of $600 in Adobe products

You can take advantage of the current credits before July 1 and still be eligible for the updated credits when they come. I’m personally disappointed that Dell isn’t gone so that I don’t have to think about it any more, but for people playing Dell buyer’s groups games, the new structure is probably better. - Zift Zillions cards earn 12x points at Giant, Martins, and Stop & Shop through

WednesdayThursday (Thanks to Eugene for the correction). Note that Giant Food stores are owned by the same conglomerate but are only paying 4x.

There’s a Citi Merchant offer for 5% back up to $30 at Stop & Shop too. (Thanks to GCA) - The best and worst performing major US airlines as measured by the stock market have Q2 shopping portal bonuses:

– AA eShopping: 500 miles after $200+ spend through April 14

– United MileagePlus Shopping: 500 miles after $100+ spend through April 14

An obvious choice is giftcards.com. - Chase Offers has an offer for 5% back at giftcards.com, and it’s potentially available on multiple cards for the same cardholder too too. (Thanks to Carl)

- The Chase Sapphire Preferred 100,000 Ultimate Rewards bonus is now available via referrals.

- US Bank’s business checking bonus for Q2 is here using promo code Q2DIG25. For both tiers of bonus, you need to maintain a minimum balance and have five transactions within the first 60 days. Last time I knocked this out, I scheduled five $1 ACHs. The tiers:

– $500 for bringing $5,000 and maintaining at least that between days 30 and 60

– $900 for bringing $25,000 and maintaining at least that between days 30 and 60

Both are interesting if you time it right, and holding $5,000 in a business checking account with US Bank is a great way to shake-loose credit card approvals. If you’re not in the US Bank footprint, opening a brokerage account or CD first will get you in the door. - United has an economy award sale for co-brand card holders with travel booked by tomorrow night for flights to Latin America through September 30. One-way fares:

– 9,000-11,000 for Mexico

– 18,000 miles for Central America

– 30,000 miles for South America

If you choose your route correctly, lie-flat business class cash upgrades can actually be quite reasonable and there’s no cancelation fee so you don’t have to slum it in the back if the cheap upgrade doesn’t materialize.

Happy Tuesday!

Eight cardboard computers at Dell will soon earn a $1,000 statement credit.