American Airlines AAdvantage reward email confirmations have a super-annoying quirk: AA never sends you an email showing both the number of miles redeemed and the record locator in the same message. Instead you’ll get two separate emails:

- One with the subject “Your recent AAdvantage Award Redemption” (shows miles used)

- One with the subject “Your trip confirmation (XXX – XXX)” (shows record locator)

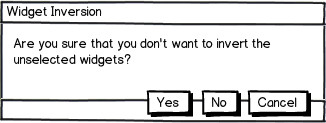

If you’re only booking one or two awards per day, it’s easy enough to suss out which redemption email corresponds which which trip confirmation, but it’s still annoying. If you book multiple awards a day it can be really hard to figure out which goes with which, especially months after booking when your email is buried behind thousands of other messages. I can only assume AA does this because their UX team decided that Windows 3.11 was the epitome of user friendliness.

Dave via MEAB slack shared that you can get an email with both the record locator and milage in the same email though, just put the award on hold, then pay for it immediately:

The award hold email lists both the record locator and award cost in a single place.

Have a nice Thursday, and check back tomorrow for all the hot takes on Delta’s devaluation rollback. (Would that properly be called a devaluation de-biggening? I’m gonna say yes, duh.)

AA’s ideal user experience model.