EDITOR’S NOTE: Some of the smartest members of the community have stepped up with guest posts during the holiday break in 2024 and now on Saturdays in early 2025. Special thanks to today’s author who needs no introduction for following up on the Early Warning Service warning (under duress). Have a nice weekend!

Everyone loved my Early Warning System (EWS) post last year, and by everyone I mean at least 2-3 people, so Matt asked me to post a bit more on the topic. I said no, but he threatened that he’d force me to load more money into Juno if I didn’t so here comes my update.

Image of the conversation of MEAB threatening me

You’re thinking to yourself “SideShowBob233 what else do you have to add here” (and this time you didn’t say the 33 out loud but kind of trailed off like someone who just got his Pepper account locked by buying too much Best Buy). Well, I will tell you. In the most rambling way possible.

I advised everyone to use a business account if at all possible, but it turns out not all business accounts are excluded from EWS reporting. Several victims reached out to me to let me know that BOA biz checking for sole proprietors does report to EWS. I don’t know if that applies to all sole proprietors or only some (I don’t have a sole proprietor account at BOA because the voices told me not to). It’s possible that other banks also report biz checking for sole proprietors, feel free to reach out on Telegram, WhatsApp, passenger pigeon, or via telepathy to send me your DPs.

But Bob you’re saying (maybe you’re getting a little too familiar with me considering we only met once and that was in a dream, albeit one where there were no clothes) why should I care if all my transfers are tracked by EWS? Who really cares? Well I’ll tell you who cares. Your mom. Also bank compliance officers (which may or may not include your mom, I haven’t tracked her career since we broke up) who when they get nervous about shenanigans we just pulled will then grab your EWS report to try and get more info on you. If they can’t find much information they may still shut you down, but if they get a 500 page report showing tons of money going everywhere you can bet they will be shutting you down faster than you can yell for your mommy.

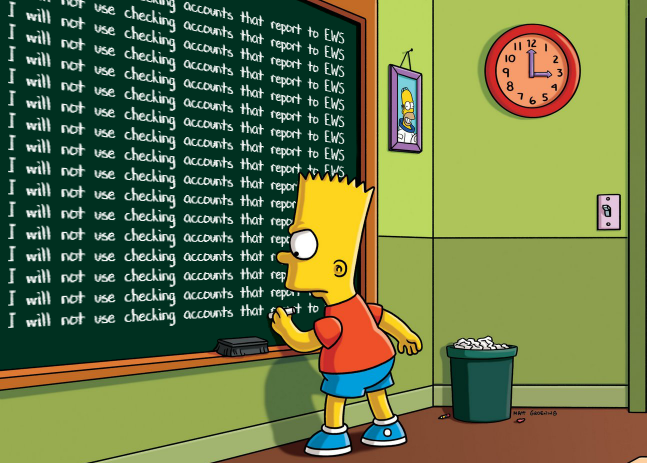

To summarize, don’t step on a rake, instead use a business checking that does not report to EWS.

Your punishment for not listening to me last year.