Background

The Chase Sapphire Preferred has had an increased sign-up bonus of 100,000 Ultimate Rewards after $5,000 spend in Chase branches since Monday of last week, and now the same offer is available directly from Chase.com. But there was another new development yesterday: Affiliate bloggers now also have links for the card.

The Impact

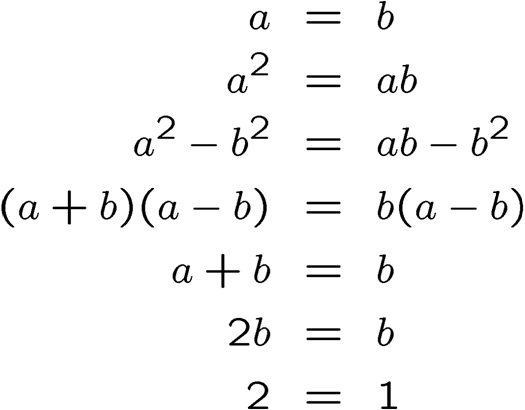

As you can imagine, this development means that the number of articles about the card shot up exponentially. Let’s sample a few headlines from the 12 hour period starting yesterday at 10AM Eastern and ending at 10PM Eastern:

- “Is the Chase Sapphire Preferred worth the annual fee?”

- “Who’s eligible for the Chase Sapphire Preferred’s 100,000 point bonus?”

- “Record-high Bonus: Earn 100,000 points with the popular Chase Sapphire Preferred for a limited time”

- “Chase Sapphire Preferred benefits: Everything you need to know”

- “The best Chase credit cards to add to your wallet”

- “10 best ways to use 100k Ultimate Rewards points: From first-class flights to all-inclusive getaways”

Affiliate bloggers can be insatiable. Now, can you guess how many different blogs it took to generate that many articles in 12 hours? The sad punchline is that it took exactly one blog. There were dozens of other articles from other blogs that could have made the list; but there was literally zero need. We got 1/3rd of a page of headlines from just a single blog.

The Motivation

Obviously the main goal for an affiliate blogger is to maximize revenue. There are two ways that they do this:

- Maximize revenue in the short term by dumping articles incessantly to reach as wide of an audience as possible

- Maximize revenue in the long term by being a “good neighbor” affiliate blogger that always [usually] gives you the best link, so you’ll trust them and keep coming back to use those links for months or years

The former strategy relies almost exclusively on creating urgency, and while it’s not directly required for the latter strategy, urgency still boosts revenue so the strategy is still a core tenet and at minimum a subtle part of the game.

The Defense

Urgency breaks our best plans, and a false sense of urgency leads directly to mistakes in the hobby, like:

- Not waiting another week a referral offer to come up with the same bonus (it probably will)

- Accidentally blowing through 5/24, 3/4/5, 2/90, or some other credit card rule because we’re worried about missing out

- Forgetting to have your credit report in a clean state before applying

- Not analyzing whether the Sapphire Preferred even makes sense

- Being annoyed about the contents of your RSS feeds and writing an article about the deteriorating state of churning blogs

Look, affiliate bloggers aren’t inherently evil and you should use an affiliate link for someone that you appreciate and want to support when it’s the right card, the right time, they haven’t steered you astray, and no referral option is available. But until you’ve made that analysis consider whether you should avoid the noid noise. Also, ain’t no affiliate links ’round MEAB so that option isn’t ever real.

Taking time to consider problems before acting works.