Introduction

We talked about Bank of America shenanigans about a year ago, and US Bank shenanigans about six months ago. As a result I think many of you have card anniversaries and half-anniversaries to consider and it’s probably worth a re-read of both. That said, today we’re going to do the same for Barclays because they’ve just increased sign-up bonuses on three of their main four co-brand cards:

- Wyndham Earner Business: 65,000 points after spending $2,000 in 60 days and another 10,000 points after a single purchase on an employee card (Update: corrected bonus from 60,000 to 65,000 points. Thanks to Miles)

- JetBlue Business: 70,000 points after spending $2,000 in 90 days and another 10,000 points after a single purchase on an employee card

- Hawaiian Business: 80,000 points after spending $2,000 in 90 days

If you live in New England or Florida, the JetBlue card is a great option. If you live near a Speedway, the Wyndham card is a stand out. If you like churning satire, the Hawaiian card can’t be beat.

Rules

Barclays doesn’t have as many loopholes as legacy banks, but there are some. Here’s what you should know:

- Barclays will combine hard pulls in the same day

- Barclays will approve up to three credit cards in the same day

- Barclays business cards won’t appear on a credit report

- Barclays’ reconsideration department will work with you more than most banks will

- Barclays won’t let you have multiple versions of the same card

To contact Barclays reconsideration, dial (866) 408-4064 for business cards or (866) 408-4064 for personal cards. When you call, a simple “I was hoping that you’d take another look at my application and help me find away to get approved. I’m happy to provide any additional information you may need!” may be enough to negotiate your way into an approval after you’re denied.

How I’m Playing It

I don’t need more JetBlue points and I really don’t need more Hawaiian points, but Vacasa redemptions via Wyndham are hard to beat. So even though the AA Business co-brand card offer isn’t at a relative high, I’ll be pairing it with the Wyndham card application for a combined hard-pull without messing with my quest to drop below 5/24.

Good luck!

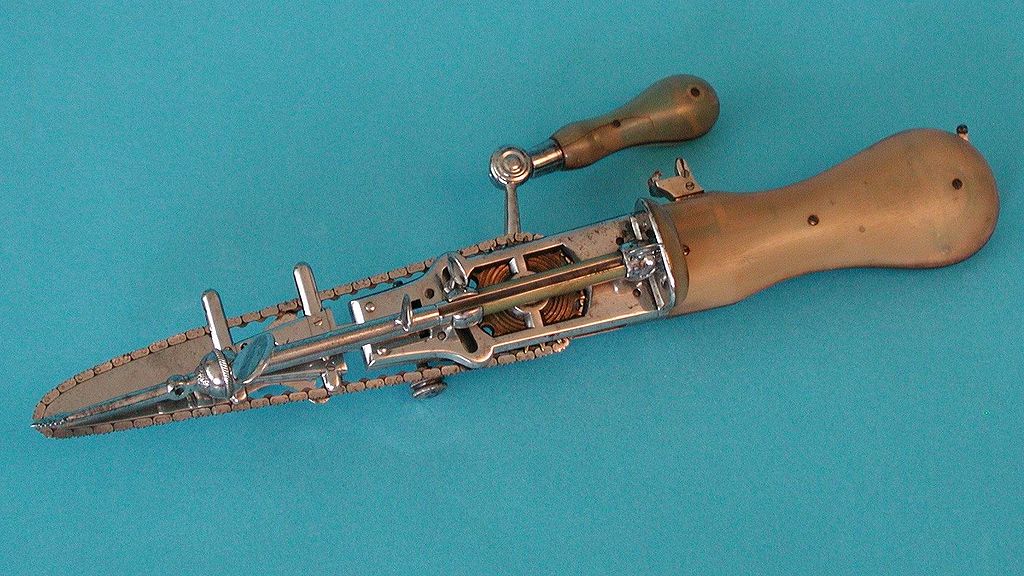

Barclays reconsideration staff is much friendlier than it looks.