- Cardless’s Avianca Elite American Express card has an increased tiered sign-up bonus worth 120,000 LifeMiles in aggregate:

– 80,000 LifeMiles after $4,500 spend in 90 days

– 40,000 LifeMiles after $25,000 spend in 365 days

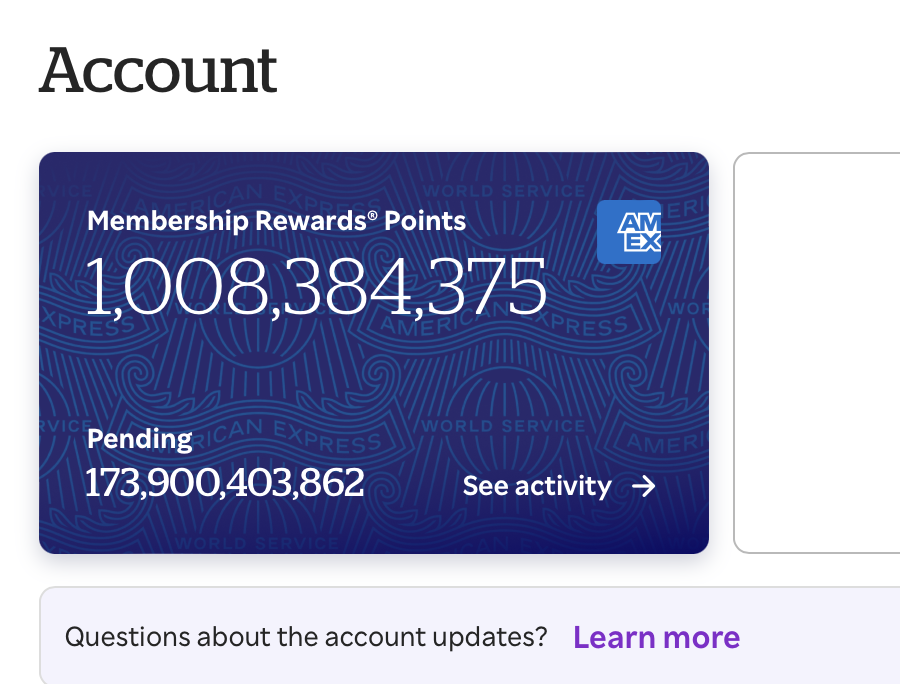

Cardless has a one card per person lifetime limit, so consider whether cards like the Qatar Privilege Club may better fit your style. The Avianca card’s best features are that: it’s a third party American Express, and that it includes a Lifemiles+ lite membership which gives award redemption rebates and a cheap upgrade to Lifemiles+ basic membership for free award cancellations. - American Express Offers has card-linked offers for either a statement credit, co-brand points, or Membership Rewards after spending $2,000-$7,000 depending on the offer. The rebates’ average values quite good at around 10% of spend. (Thanks to DoC)

- Giant, Giant Foods, Martins, and Stop & Shop stores have 3x points on Visa gift card purchases through Thursday, limit $2,000 spend per account.

- Giftcards.com has a bonus $10 giftcards.com gift card with the purchase of a $100 Virtual Visa gift card through Wednesday using promo code GOBBLE, limit one per transaction. The great

ironysadness is that giftcards.com gift cards can’t be used to purchase Visas or Mastercards. - Do this now: Check your email inbox for a targeted $50 Marriott Bonvoy bonus gift card, but also note that it expires on December 21. A good search query is probably: “in:anywhere subject:Enjoy a gift from Marriott Bonvoy to celebrate your upcoming stay”.

Happy Monday!

Once per lifetime Cardless credit card unboxing photo, presumably.