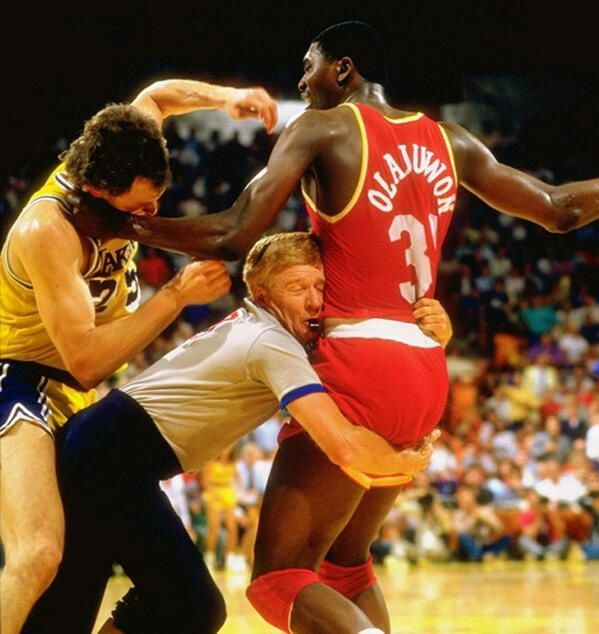

- The Citi Shop Your Way Rewards card, the 1990s Hakeem Olajuwon of credit cards and a MEAB Unsung Hero, has a few new targeted offers for online spend through September 14 via email. We’ve seen:

– $40 statement credit with $600 spend

– $80 statement credit with $800 spend

– 7,000 ThankYou Points with $600 spend

– 200,000 Shop Your Way Rewards with $600 spend

This offer will stack with the current offers for utilities too, provided you can pay your utility bill online. (Thanks to Mike, Santosh, and Jacob) - Promotional Southwest Companion Passes from Southwest’s April offer are now active for bookings through September 30, and are working on both paid and award bookings. (Thanks to sctrader)

- Costco has $500 Alaska Airlines e-gift cards on sale for $449.99, limit 10 per member. These can be loaded to your Alaska wallet too which makes it easy to track, but wallet funds do quasi-expire. (Generally Alaska will renew soon expiring wallet funds after asking nicely on

TwitterX, a great tip courtesy of Sam at Milenomics)

UPDATE: Mike sent a correction about Alaska wallet fund expiration; funds added directly with a credit, debit, or gift card don’t expire. - Safeway and Albertsons family stores have unlimited 5x Just4U points earning on Uber gift cards $50 or greater through August 28. These can be a back-door way to earn Alaska miles too. (Thanks to GCG)

Happy Wednesday!

If Olajuwon is the Shop Your Way Card, churners are the referee, I guess?