Introduction

When you start manufactured spending, the biggest limiting factor for scale is usually your lack of knowledge and experience in the field. Once you learn a few techniques and find the right plays, the limiting factor will probably turn into your float; that is, outstanding available cash and credit line balances.

You know you’ve hit float as a limiting factor when you immediately want to use a deposit that shows as “available” in your bank account on Tuesday morning to pay down a balance on your credit card, so that you can go spend and repeat the cycle on Tuesday afternoon. Listen Trigger, I know that in the modern world of Zelle, ACHs, and other electronic money transfers, it sure looks like money is available to pay a credit card the moment the bank tells you it is. The problem though, is that the bank is lying to you.

Cleared Funds

Even though a bank shows your balance as available and lets you send it away with a few clicks, it’s really not fully available because banks are still living in a technology world that’s a decade behind our own at best. Your electronic or money order deposits aren’t actually cleared funds (definitively in the accounts of the receiving bank) when most banks make them available to you. When are they actually cleared funds?

- ACH, Zelle, and other electronic deposits: Three business days

- Wires: Up to one business day

- Cashiers checks and money orders: One business day

There’s an additional rub: there are different cut-off times depending on the bank, how large its assets are, and the type of transaction, but typically it’s safe to assume that if you make a deposit or receive an electronic transfer after 2PM Eastern, you’ve missed the bank’s business day and a deposit after that time is effectively no different than a deposit the next morning.

Kiting and Shutdowns

Kiting is floating money in-and-out before it clears, intentionally knowing that ultimately it won’t clear and running away with the funds before the bank knows what’s happened. Kiting is illegal and if all that happens from actual kiting is a bank shutdown, you’re really lucky. But a manufactured spender paying their credit line the moment deposits are available isn’t kiting because the funds will clear, so what’s the problem?

Easy, when it looks like you’re potentially kiting, a bank’s risk department will take a look at your accounts and almost certainly shut you down. It doesn’t matter if you weren’t actually kiting and your deposits all eventually clear, the bank still sees major movement before money is cleared as a big risk, and when you’ve scaled your manufactured spend that risk eventually becomes untenable and you’ll get the axe, “out of an abundance of caution“.

How does one stay alive? Be aware of the timelines for cleared funds, and don’t move money out of your bank account before funds are cleared, even if the bank shows your balance as available and lets you move money out the same day. Stay alive friends!

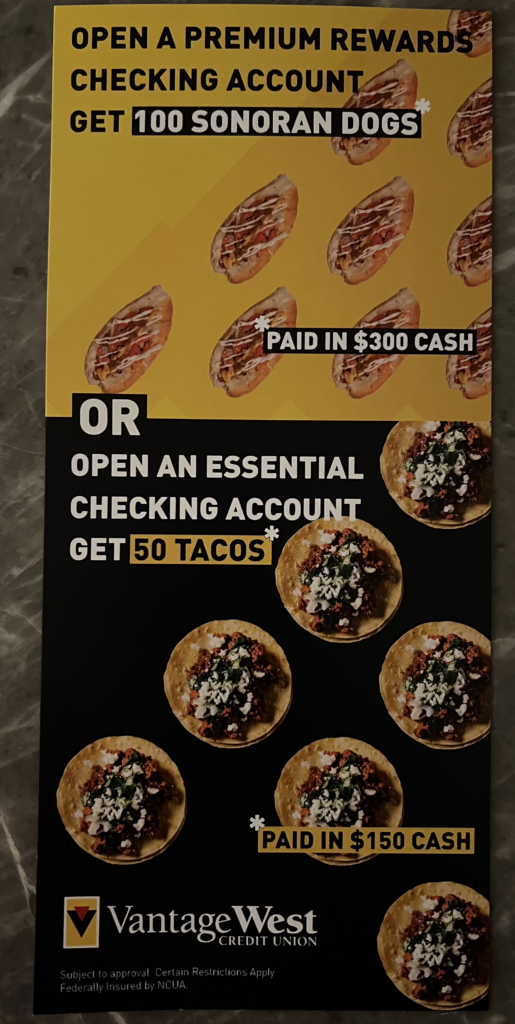

Another consequence of kiting.