Kroger’s current 4x promotion on third party gift cards combined with the following gives you quite a bit of opportunity over the weekend:

- Lowe’s has a free $15 store gift card offer with each $200 Mastercard purchased through May 11. A few notes on this deal:

– The resale rate on $15 Lowe’s gift cards is approximately 87%

– The capacity on this is effectively unlimited if you get a friendly store

– The deal terms say “limit 2 per email address”, but in the past that’s never been an actual limit. If it turns out to be an issue, use the gmail plus or dot syntaxThese cards are Metabank issued gift cards so make sure you have a way to liquidate those. (Thanks to GC Galore).

- Staples has fee free $200 Visa gift cards starting Sunday and running through Saturday of next week, limit five per customer (per transaction in practice). As usual, they’re Metabank issued gift cards so make sure you have a way to liquidate those.

- Simon has 55% off of all purchase fees through tomorrow evening with code 22CINCO55, including the $1,000 Visa variety. Blah, blah, Metabank, blah blah though.

- The Point debit card has 5x on up to $1,000 spend between now and Sunday at Walmart and up to $1,000 spend Whole Foods, both of which sell gift cards and potentially other interesting manufactured spend things.

If you want the Point debit card, use a referral for a bigger sign-up bonus than the public offer. Note that referral bonuses currently vary from person to person, so ask around for one in the $100-$200 range; I wouldn’t consider one below $100 as the card now carries a $99 fee.

- American Express is targeting more accounts this week for 20,000 Membership Rewards after turning on pay-over-time. Unlike past iterations of this offer with a specific link and embedded offer code, this one is showing up on the regular pay-over-time landing page for your default (starred) card. If your default card isn’t showing an offer, switch another charge to be default and check the landing page again. (Thanks to Justmeha for helping me clarify the language)

Have a nice weekend!

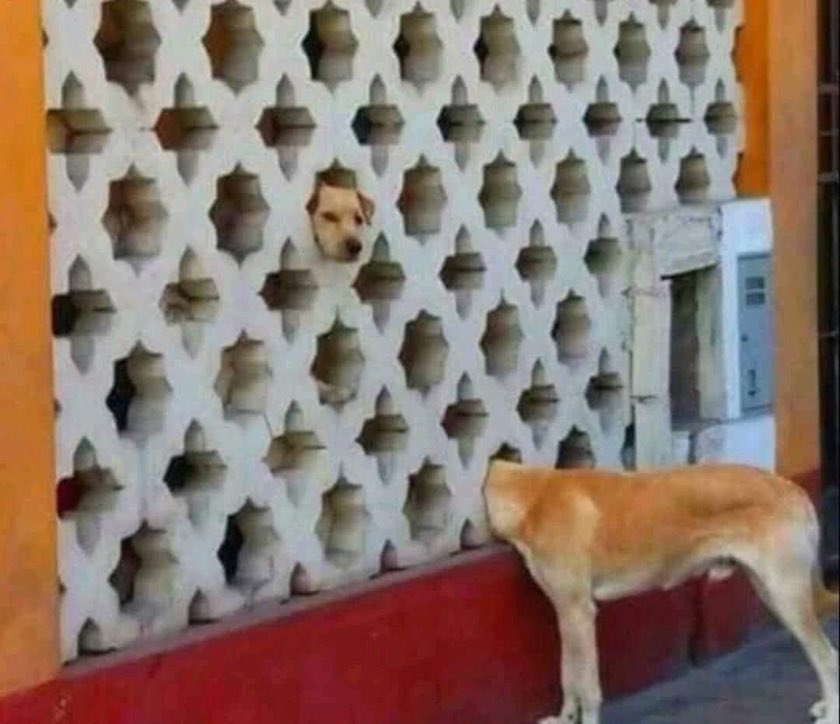

Visiting the Lowe’s clearance section to find Mother’s Day gifts after buying Mastercards.